Introduction

Parag Parikh Flexi Cap Fund, a popular choice in the Flexi Cap category, has seen its fortunes turn recently. Despite impressive AUM growth, the fund’s performance this year has been lacklustre. Let’s see if this short-term dip is a cause for concern for investors. We’ll deep dive into the fund’s historical performance and investment strategy to help you decide if Parag Parikh Flexi Cap remains a good fit for your portfolio.

Flexi Cap Funds: Imagine a mutual fund that can invest across the entire market capitalisation spectrum, from large, established companies (large-cap) to smaller, high-growth companies (mid-cap and small-cap). That’s a flexi cap fund! These funds offer portfolio managers the flexibility to invest wherever they see the best opportunities to generate the best returns for the fund investors.

Parag Parikh Flexi Cap Fund (PPFAS Flexi Cap Fund): Launched in 2013, this fund from PPFAS Mutual Fund is a popular choice in the flexi cap category. It’s known for its focus on value investing and its ability to generate strong returns over the long term.

This blog post aims to dive deep into the Parag Parikh Flexi Cap Fund (PPFAS Flexi Cap Fund). We’ll be reviewing the Parag Parikh Flexi Cap Fund’s performance, investment strategy, and suitability for different investors to help you decide: Should you invest in the PPFAS Flexi Cap Fund?

Fund’s long-term track record

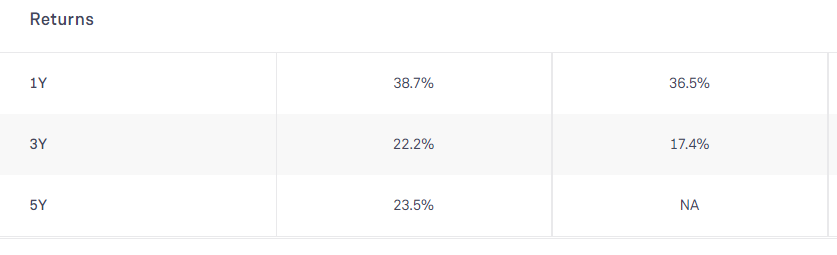

The Parag Parikh Flexi Cap Fund boasts an impressive long-term track record. Since its launch in 2013, the fund has consistently delivered returns that have surpassed its benchmark, the NIFTY 500 TRI. This means the fund has managed to grow investor wealth at a faster pace than the broader Indian stock market.

See here the comparison between the PPFAS Flexi cap fund vs the Nifty 500.

This fund has consistently outperformed the benchmark in the long term.

Understanding 2022’s Underperformance

It’s important to acknowledge that while the PPFAS Flexi Cap Fund has a strong historical performance, 2022 was a year of underperformance. The fund’s returns fell short of the benchmark, leaving some investors concerned. There are a couple of key reasons behind this:

- Correction in International Holdings: The fund has a unique strategy that includes investing in promising international companies alongside Indian holdings. In 2022, some of these international holdings experienced a correction, dragging down the fund’s overall returns.

- SEBI Restrictions: The Securities and Exchange Board of India (SEBI) also implemented temporary restrictions on new investments in overseas stocks by certain mutual funds in 2022. This limited the fund’s ability to fully deploy its investment strategy.

Also Read: How to invest in Index funds

The Core of PPFAS Flexi Cap Fund’s Strategy

PPFAS Flexi Cap Fund isn’t chasing the hottest stocks or the latest trends. Instead, it follows a value investing approach, focusing on identifying companies that are trading for less than their intrinsic value.

Here’s how the fund’s stock picking works:

- Focus on Fundamentals: The fund managers meticulously analyze a company’s financial health, looking at metrics like profitability, cash flow, and debt levels.

- Undervalued Gems: They seek companies with strong fundamentals but whose stock prices are currently undervalued by the market. This could be due to temporary market sentiment or an underappreciated business model.

- Long-Term Potential: The fund invests with a long-term perspective, believing that these undervalued companies will eventually be recognized by the market, leading to a rise in their stock prices.

This value investing approach allows the fund to potentially:

- Mitigate Risk: By focusing on companies with strong fundamentals, the fund aims to reduce the risk of investing in overvalued stocks that could experience a sudden price drop.

- Generate Stable Returns: Value investing has a history of generating consistent and stable returns over the long term, even if the ride isn’t always smooth.

PPFAS Flexi Cap Fund takes its diversification strategy a step further by venturing beyond the Indian market and including promising international companies in its portfolio. This international exposure offers several potential benefits:

- Enhanced Returns: International markets can provide access to unique growth opportunities that might not be available in India. By tapping into these markets, the fund has the potential to generate higher returns for investors.

- Reduced Risk: Economic cycles and market fluctuations can vary between countries. When one market experiences a downturn, another might be performing well. International diversification helps spread risk across different markets, potentially mitigating the impact of a slowdown in any single market.

However, there are also challenges associated with international investing:

- Currency Fluctuations: The value of the Indian rupee can fluctuate against other currencies. If a foreign holding performs well but the rupee weakens, it can negate some of those gains when converted back to rupees.

- Geopolitical Risks: Political and economic instability in other countries can impact the performance of companies held by the fund.

The recent underperformance in 2022 highlighted these challenges. The correction in some of the fund’s international holdings and temporary SEBI restrictions on overseas investments limited the fund’s ability to fully capitalize on its diversification strategy.

| Pros | Cons |

|---|---|

| Proven Track Record: The fund boasts a long-term history of consistently outperforming its benchmark, showcasing its ability to generate strong returns for investors. | Recent Underperformance: The fund’s performance in 2022 fell short of expectations, raising concerns about its ability to consistently deliver strong returns. Investors should be aware of this and understand the reasons behind it (discussed earlier). |

| Global Exposure: The fund’s international diversification offers the potential for enhanced returns and reduced risk by tapping into growth opportunities and economic cycles beyond the Indian market. | Increased Risk: The fund’s international diversification strategy adds an element of higher risk due to factors like currency fluctuations and geopolitical instability in foreign markets. |

| Seasoned Management: The fund is steered by experienced fund managers with a value investing approach, known for their focus on identifying undervalued companies with long-term potential. |

Also Read: How to make the best mutual fund portfolio for you

Who Should Consider PPFAS Flexi Cap Fund?

Given the fund’s characteristics, it can be a good fit for specific investor profiles:

Suitable For:

- Moderate Risk Appetite: Investors comfortable with some level of risk in exchange for the potential for higher returns may find PPFAS Flexi Cap Fund appealing. The fund’s focus on value investing and experienced management can help mitigate some risk, but there’s still inherent volatility associated with the stock market and international exposure.

- Long-Term Horizon: The fund’s value investing strategy is geared towards the long term. Investors with a time horizon of at least 5-7 years can benefit from the fund’s potential for consistent growth and capital appreciation.

Not Ideal For:

- Risk-Averse Investors: Investors who cannot tolerate any fluctuations in their investment value should look for safer options like fixed deposits or debt funds.

- Short-Term Goals: PPFAS Flexi Cap Fund is not suitable for investors seeking short-term gains. The fund’s value investing approach might experience periods of underperformance, and the stock market can be unpredictable in the short term.

Summary

The Parag Parikh Flexi Cap Fund offers a unique combination of a strong historical track record, experienced fund management, and the potential benefits of international diversification. However, recent underperformance and inherent risks associated with its investment strategy are essential factors to consider.

Key Points to Remember:

- The fund has a history of exceeding the benchmark NIFTY 500 but experienced a setback in 2022 due to factors like international holding corrections and SEBI restrictions.

- It follows a value investing approach, focusing on undervalued companies with long-term potential.

- Global exposure offers the chance for enhanced returns and reduced risk through diversification, but also introduces currency fluctuations and geopolitical risks.

*Investment Decisions are Individual.

*This blog post aimed to provide an analysis of the PPFAS Flexi Cap Fund to help you make informed investment decisions. Remember, your investment choices should depend on your individual risk tolerance, financial goals, and investment horizon. Consulting with a qualified financial advisor can be beneficial to determine if this fund aligns with your overall investment strategy.

*Disclaimer: The information provided in this blog post is for educational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any investment decisions.