About the Company

- Protean eGov Technologies is a leading provider of IT-enabled solutions to the government and public sector in India. Earlier it was known as NSDL e-Governance Infrastructure Limited.

- The company has played a key role in the digitization of government services in India such as Income Tax e-Filing, Passport Seva, e-District & e-Procurement.

- TheProtean eGov Technologies IPO is open for subscription from November 6 to 14, 2023 with a price band of Rs 752-792 per share. The company is planning to raise Rs 490 crore at the upper end by offer for sale of 61.9 lakh shares.

Company Website: https://www.proteantech.in/

The products & services offered by the company:

Protean eGov Technologies offers a wide range of products and services, including:

- Digital infrastructure solutions: Protean eGov Technologies develops and deploys digital infrastructure solutions, such as data centers, cloud computing platforms, and networks, for government agencies.

- E-governance applications: Protean eGov Technologies develops and implements e-governance applications, such as income tax e-filing, passport Seva, and e-District.

- System integration and managed services: Protean eGov Technologies provides system integration and managed services for government agencies. These services include the design, implementation, and maintenance of IT systems.

- Security solutions: Protean eGov Technologies provides security solutions for government agencies, such as firewalls, intrusion detection systems, and data security solutions.

The company also offers a number of other products and services, such as:

- Open Digital Ecosystems (ODE): ODE is a platform that enables government agencies to share data and collaborate with each other and with the private sector.

- VidyaLakshmi: VidyaLakshmi is a platform that provides students with access to educational loans.

- Central Recordkeeping Agency (CRA): Protean eGov Technologies is the CRA for the National Pension System (NPS) and the Atal Pension Yojana (APY). As the CRA, Protean eGov Technologies is responsible for managing the records of NPS and APY subscribers.

- Aadhaar Authentication & e-KYC Services: Protean eGov Technologies provides Aadhaar authentication and e-KYC services to government agencies and businesses.

Protean eGov Technologies’ products and services are used by a wide range of government agencies, including the Central Government, State Governments, and various government agencies. The company’s products and services help government agencies to improve the efficiency and effectiveness of their operations, and to deliver better services to citizens.

useful information

Protean IPO Lot Size

| IPO Activity | Date |

|---|---|

| Issue Price | 752-792 |

| Market 1 Lot: | 18 Shares |

| 1 Lot Amount: | 14256 |

| Min Small HNI Lots(2-10 Lakh): | 15 Lots |

| Min Big HNI Lots(10+ Lakh): | 71 Lots |

Protean IPO Dates

| IPO Activity | Date |

|---|---|

| IPO Open Date | 06-11-2023 |

| IPO Close Date | 08-11-2023 |

| Basis of Allotment Finalization Date* | 13-11-2023 |

| Refunds Initiation* | 15-11-2023 |

| Credit of Shares to Demat Account* | 16-11-2023 |

| IPO Listing Date* | 17-11-2023 |

Protean IPO Details

| IPO Issue Price: | 752-792 Per Share |

| DRHP: | – |

| RHP: | Download RHP |

| IPO Listing At: | BSE |

| Retail Quota: | Not less than 35% of the Net Issue |

| IPO Issue Type: | Book Build Issue |

| IPO Issue Size: | ₹490.33 Cr |

| OFS Issue: | ₹490.33 Cr |

| Face Value: | ₹10 Per Equity Share |

| Promoter Holding Pre IPO: | – |

| Promoter Holding Post IPO: | – |

Key risks

The key risks associated with the Protean IPO include:

- Dependence on the government sector: Protean eGov Technologies’ business is highly dependent on the government sector, which is subject to various risks, such as changes in government policies and priorities, and delays in payments.

- Concentration of customer base: Protean eGov Technologies’ customer base is concentrated among a few large government agencies. This means that the company is vulnerable to the loss of any of these key customers.

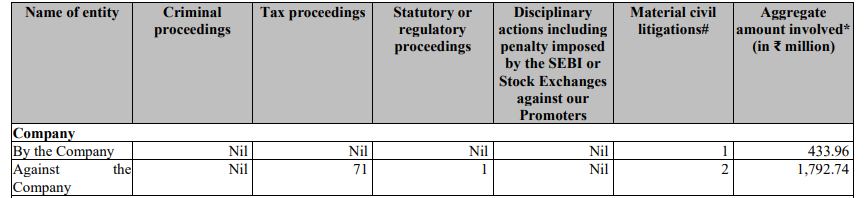

- Litigations: There are pending litigations against the company. Any negative decision would affect the business. The summary of pending litigations is as below:

Protean Past Financials

Here are the key financial highlights and takeaways from Protean eGov Technologies Ltd for the past three completed financial years:

Financial Highlights: The table below presents the key financial figures for Protean eGov Technologies Ltd for the last three fiscal years (FY21, FY22, and FY23):

| Particulars | FY23 | FY22 | FY21 |

|---|---|---|---|

| Net Revenues (₹) | 783.87 Cr | 770.18 Cr | 652.03 Cr |

| Sales Growth (%) | 1.78% | 18.12% | – |

| Profit after Tax (₹) | 107.04 Cr | 143.94 Cr | 92.19 Cr |

| PAT Margins (%) | 13.66% | 18.69% | 14.14% |

| Total Equity (₹) | 856.94 Cr | 788.00 Cr | 667.46 Cr |

| Total Assets (₹) | 1,104.10 Cr | 988.14 Cr | 862.39 Cr |

| Return on Equity (%) | 12.49% | 18.27% | 13.81% |

| Return on Assets (%) | 9.69% | 14.57% | 10.69% |

| Asset Turnover Ratio (X) | 0.71 | 0.78 | 0.76 |

Key Takeaways:

- Erratic Revenue Growth: Over the last three years, Protean eGov Technologies Ltd has experienced erratic revenue growth. This could be attributed to projects being at different stages of implementation. However, the company’s value goes beyond just the numbers, as its criticality and hidden value may not be fully realized.

- Profit and ROE Volatility: Profits and Return on Equity (ROE) are not easily comparable due to significant volatility and tepid profits in the latest fiscal year (FY23). Despite this, the net margins of 13.66% and ROE of 12.49% in the latest year are still attractive. The key is to ensure that these figures remain sustainable in the long term.

- Asset Utilization: While the company has had below-average asset turnover ratios, this may not be very relevant for a digital infrastructure company. However, the Return on Assets (ROA) for the latest year, at 9.69%, is quite attractive.

- IPO Valuation: Based on a weighted average earnings per share (EPS) of ₹29 per share, the stock is being offered in the IPO at a Price-to-Earnings (P/E) ratio of 27.3 times. This is attractive if the current growth rate in profits can be sustained, making the stock relatively cheaper. Protean eGov Technologies Ltd is a rare fintech company that is consistently profitable and has a significant share of government-sponsored projects. The company has also built strong entry barriers that would be challenging for new players to replicate. Additionally, its scale and pan-India infrastructure are cutting-edge. Investors in the IPO should consider participating with a long-term view, as this presents an opportunity to invest in a robust fintech player at a time when the financialization of savings is expected to grow significantly.

What is the difference between NSDL and Protean eGov ?

National Securities Depository Limited (NSDL) was incorporated in 1995. Depository operations were started in 1996 by NSDL Depository Limited, which was wholly owned subsidiary of NSDL.

In Dec 2012 the name of the company was changed from NSDL to NSDL e-Governance Infrastructure Limited. in 2021 name of the company was changed from NSDL e-Governance Infrastructure Limited to ‘Protean eGov Technologies Limited.

National Securities Depository Limited is a depository registered with SEBI. Potean eGov is not engaged in the business of providing depository services under the Depositories Act and is not a SEBI-regulated entity.

As of now, both entities have been demerged, National Securities Depository Limited is carrying out depository business, and NSDL e-Governance Infrastructure Limited is undertaking activities other than depository viz. TIN, PAN, CRA, UID, etc.

To read more about the demerger click here.

Protean IPO Allotment Status Check

Check Chavda Infra SME IPO allotment status on the Linkintime website allotment URL. Click Here

On the IPO GMP Dashboard, you can view the live GMP status of all current and past IPOs (issues that have been closed but have not yet been listed). Moneyvigyan.com continually updates the performance of the IPO GMP. The listing price and the IPO GMP can be tracked and compared here on the IPO GMP Dashboard.

FAQs

When does the Protean IPO open and close?

the Protean IPO is open from 6th November to 8th November 2023.

What is the allotment date for the Protean IPO?

The allotment date for Protean IPO is 13th Sep 2023.

What is the listing date for the Protean IPO?

The Protean IPO will be listed on the 17th of November.

What is the price band for Protean IPO?

the price band for Protean IPO is Rs. 752-792

Disclaimer: No financial information published anywhere on this site should be interpreted as a recommendation to buy or sell securities or as any other kind of offer to do so. Every piece of material published on this site is just for educational and informational reasons and under no circumstances should be used to make financial decisions. Before actually making any investment decisions based on the information provided here, readers must seek the advice of a licensed financial professional. Any actions made by readers based on the material presented here are done so entirely at their own risk. Investors should be aware that any stock market investment is exposed to unpredictably high market risks. The author has no intention of investing in this IPO.