AU Bank has launched India’s first customizable credit card, the LIT credit card. This credit card offers you multiple rewards programs that you can pay for and activate as per your needs. This is a lifetime free credit card that offers 1% base reward points. If you want higher reward points for your shopping then you can just activate that offer from the AU bank app.

Key Features of LIT Credit Card

| Joining Fee | Nil |

| Annual Fee | Nil |

| Best Use | Rewards, Cashback, Milestone benefits, Fuel, Airport Lounge access |

| Best Feature | Customizable reward feature option |

| Rewards | 10X or 5X reward points on online and offline purchases(using POS machines) |

How does the AU LIT Credit card work

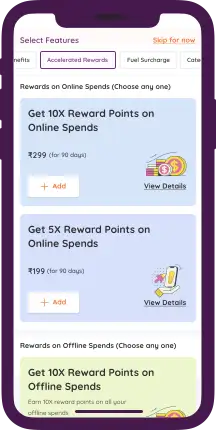

This credit card is a bit different from other credit cards. This credit card has 16 reward features which you can turn on and off at your convenience. Once you activate a reward program from the app, it will be valid for 90 days. During this period you will be able to enjoy the benefits of that particular rewards program.

The list of these reward features is as follows:

| S. No. | Benefit | Fee |

| 1 | Airport Lounge Access (2 visits) | 299 |

| 2 | Airport Lounge Access (1 visit) | 199 |

| 3 | 5% Additional Cashback (on retail spends) | 299 |

| 4 | 2% Additional Cashback (on retail spends) | 199 |

| 5 | 5x Reward Points on Online Transactions | 199 |

| 6 | 10x Reward Points on Online Transactions | 299 |

| 7 | 5% Cashback on Dining | 299 |

| 8 | 10X Reward Points on Offline Transactions | 299 |

| 9 | 5% Cashback on Clothes Shopping | 199 |

| 10 | 5% Cashback on Grocery Shopping | 199 |

| 11 | 3 Months Membership of cult.fit | 499 |

| 12 | Amazon Prime Membership for 3 Months | 199 |

| 13 | 1% Fuel Surcharge Waiver | 49 |

| 14 | 5% Cashback on Electronic Spends | 299 |

| 15 | 5x Reward Points on Offline Spends | 199 |

| 16 | 5% Cashback on Travel Spends | 299 |

To put it simply you only pay for the feature which you want to use. The paid-for feature will be active for 90 days from the date of payment.

The purchased reward points will be in addition to 1% base reward program.

Before activating any feature be sure to read all the terms and conditions associated with it, which are easily available on the app.

Also Read: RBL bank Shoprite credit card Review

AU LIT Credit Card Benefits

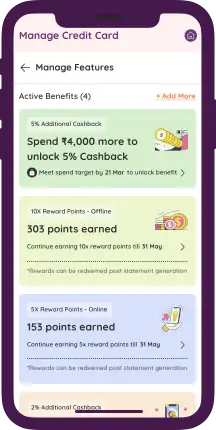

Accelerated Reward Points

With AU LIT credit card your shopping becomes much more rewarding. You will get 10x or 5x reward points on all online domestic & international retail transactions. You will also get 10X or 5X Reward Points on all POS and contactless offline domestic & international transactions.

Note: Reward Points can be redeemed post-statement generation. Cash withdrawal, Fuel & EMI transactions will not be eligible for Program/Base Reward Points. Fuel, rent, & cash withdrawal transactions will not be eligible for Accelerated rewards i.e. 5X or 10X Reward Points

Cashback

AU LIT card offers you two exciting cashback programs.

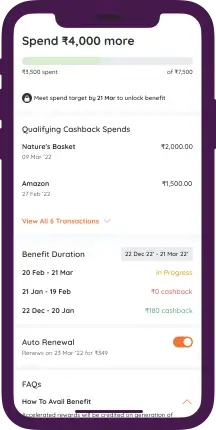

10% Cashback

- Earn 5% cashback on your retail purchases (minimum spending of INR 7,500) three times within 90 days.

- You’ll get this bonus cashback on top of your regular 1 Reward Point per INR 100 spent and the base cashback rate.

- The maximum bonus cashback earned in a 30-day period is INR 500. This will be automatically adjusted against your credit card bill.

2% Cashback:

- Earn 2% cashback on your retail purchases (minimum INR 10,000) three times within 90 days.

- Similar to the 5% offer, you’ll get this bonus on top of your regular rewards.

- The maximum bonus cashback earned in a 30-day period is INR 1,000, also adjusted against your credit card bill.

1 Reward point = 0.25 Paisa

Note: Fuel, rent, and cash withdrawal transactions won’t count towards the cashback milestones.

So, start shopping and watch your cashback stack up! Remember, you have 90 days to claim these bonuses three times each.

Lounge Acess:

With the AU LIT credit card, you can purchase 2 lounge access plan for Rs. 299 and 1 lounge access plan for Rs. 199. Once purchased, the validity of this plan shall be for 90 days.

Also Read: IndusInd Bank Tiger credit card review: Premium lifetime free card

AU Bank LIT Credit Card: Lounge access list

The list of Airport Lounges within India applicable for AU Bank LIT Credit Card is as below:

| Sr No | City | Lounge Name | Terminal | Lounge Type |

| 1 | Amritsar | Primus Lounge | Domestic | Domestic |

| 2 | Chandigarh | Cram Bar | Domestic Terminal | Domestic |

| 3 | Chandigarh | Cram Bar | International Terminal | International |

| 4 | Guwahati | Primus Lounge | Domestic | Domestic |

| 5 | Indore | Primus Lounge | Domestic | Domestic |

| 6 | Jaipur | Primus Lounge | Domestic | Domestic |

| 7 | Madurai | Primus Lounge | International | International |

| 8 | Vadodara | Premium Lounge | International | International |

| 9 | Mumbai – T2 (Arrival) | Aviserv Lounge | Terminal 2 | International |

| 10 | Nagpur | Mandarin Lounge | Domestic | Domestic |

| 11 | Srinagar | Paahun The Executive Lounge | Terminal 1 | International |

| 12 | Ahmedabad | The Lounge | Terminal 1 | Domestic |

| 13 | Mumbai- T1B | Oasis Lounge | Terminal 1 | Domestic |

| 14 | Lucknow | The Lounge | Terminal 2 | Domestic |

| 15 | Bhubaneswar | Bird Lounge | Terminal 1 | Domestic |

| 16 | Dehra Dun | Bird Lounge | Domestic | Domestic |

| 17 | Coimbatore | BlackBerry Restaurant & Bar | Domestic | Domestic |

| 18 | Goa | Good Times Bar (Lounge Alternate) | #N/A | Domestic |

| 19 | Kozhikode | Bird Lounge | Terminal 2 | International |

| 20 | Nagpur | Plaza Premium Lounge | Domestic | Domestic |

| 21 | Trivandrum | Bird Lounge | Terminal 2 | International |

| 22 | Kannur | Pearl Lounge | International | International Terminal |

| 23 | Pune | Earth Lounge | Terminal 1 | Domestic |

| 24 | Chennai | Travel Club | Domestic Terminal | Domestic |

| 25 | Chennai | Travel Club | Domestic Terminal | Domestic |

| 26 | Kolkata | Travel Club | Terminal 1 | Domestic |

| 27 | Kolkata | Travel Club Lounge Anex | Terminal 1 | Domestic |

| 28 | Chandigarh | Plaza Premium Lounge | Domestic Terminal | Domestic |

| 29 | Hyderabad | Plaza Premium Lounge | Domestic | Domestic |

| 30 | New Delhi T1 | Encalm Lounge | Terminal 1D | Domestic |

| 31 | Mumbai- T1C | Travel Club | Terminal 1 | Domestic |

| 32 | New Delhi T2 | Plaza Premium Lounge (Domestic Departures) | Terminal 2 | Domestic |

| 33 | New Delhi T3 (Arrivals) | Plaza Premium Lounge (Domestic Arrivals) | Terminal 3 | Domestic |

| 34 | New Delhi T3 | Plaza Premium Lounge (Domestic Departures) | Terminal 3 | Domestic |

| 35 | New Delhi T3 (Arrivals) | Plaza Premium Lounge (International Arrivals) | Terminal 3 | International |

| 36 | Cochin | Earth Lounge | Terminal 1 | Domestic |

| 37 | Amritsar | Plaza Premium Lounge | International Terminal | International |

| 38 | Bangalore | 080 Domestic Lounge | Domestic Terminal | Domestic |

| 39 | Kannur | Pearl Lounge | Domestic | Domestic Terminal |

| 40 | Chandigarh | Plaza Premium Lounge | International Terminal | International |

| 41 | Ahmedabad | The Lounge | Terminal 2 | International |

| 42 | Hyderabad | Plaza Premium Lounge | International | International |

| 43 | New Delhi T3 | Plaza Premium Lounge (International Departures) | Terminal 3 | International |

| 44 | Mumbai – T2 (Mals) | Travel Club | Terminal 2 | International |

| 45 | Bangalore | 080 International Lounge | International Terminal | International |

| 46 | Chennai | Travel Club | International Terminal | International |

| 47 | Chennai | Travel Club | International Terminal | International |

| 48 | Chennai | Travel Club | International Terminal | International |

| 49 | Kolkata | Travel Club | Terminal 2 | International |

| 50 | Kolkata | Travel Club | Terminal 2 | International |

| 51 | Cochin | Earth Lounge | Terminal 3 | International |

| 52 | Mumbai – T2 (Loyalty Lounge) | Loyalty Lounge | Terminal 2 | International |

AU LIT Credit Card Fee and Charges

| Charge | Fee/Rate |

| Joining Fee | Free |

| Annual Fee | Free |

| Annual Percentage Rate (APR) | 43.08% |

| Add-on Card Fee | Free |

| Minimum Repayment Amount | 5% |

| Cash Withdrawal Fee | 2.50% |

| Cash Advance Limit | 20% |

| Card Replacement Fee | ₹ 100 |

| Foreign Transaction Fee | 3.49% |

| Over Limit Penalty | 2.50% |

| Reward Point Redemtipn | ₹ 99 |

| Reward Point Value | ₹ 0.25 |

Late payment charges

| Outstanding Balance | Late Payment Charge |

| Below ₹ 100 | Nil |

| ₹100 to ₹500 | ₹ 100 |

| ₹500 to ₹5000 | ₹ 500 |

| ₹5000 to ₹10000 | ₹ 700 |

| ₹10000 to ₹20000 | ₹ 800 |

| ₹20000 to ₹50000 | ₹ 900 |

| Above ₹50000 | ₹ 1100 |

How to apply for AU Bank LIT Credit Card?

There are two ways to apply for the LIT Credit Card: online and offline.

Online application

- Download the AU 0101 app on your phone.

- Log in and go to the credit card homepage and click on “Manage your credit card”.

- Check the price of each feature and choose as per your affordability.

- You can choose or modify your features as per your needs.

- You can also switch off your auto-renewal whenever you need it on your app.

- You can keep track of your spending and manage it on the AU 0101 app.

Offline application

- Visit the nearest AU Bank branch.

- Fill in the credit card application form and attach the documents required.

Conclusion

In conclusion, the AU Bank LIT Credit Card presents a unique offer for individuals seeking a highly customizable credit card experience. Its unique blend of personalized rewards, diverse benefits, and absence of an annual fee caters to a wide range of needs and lifestyles. The freedom to choose perks and programs aligned with individual spending patterns sets this card apart from traditional one-size-fits-all offerings.

However, a careful evaluation of associated fees and responsible credit usage remain crucial considerations before embracing this flexible financial tool. Overall, the AU Bank LIT Credit Card offers significant potential for value and convenience, solidifying its position as a noteworthy contender in the competitive credit card market.

2 thoughts on “AU Bank LIT Credit Card: India’s 1st customizable credit card, Apply Now!”