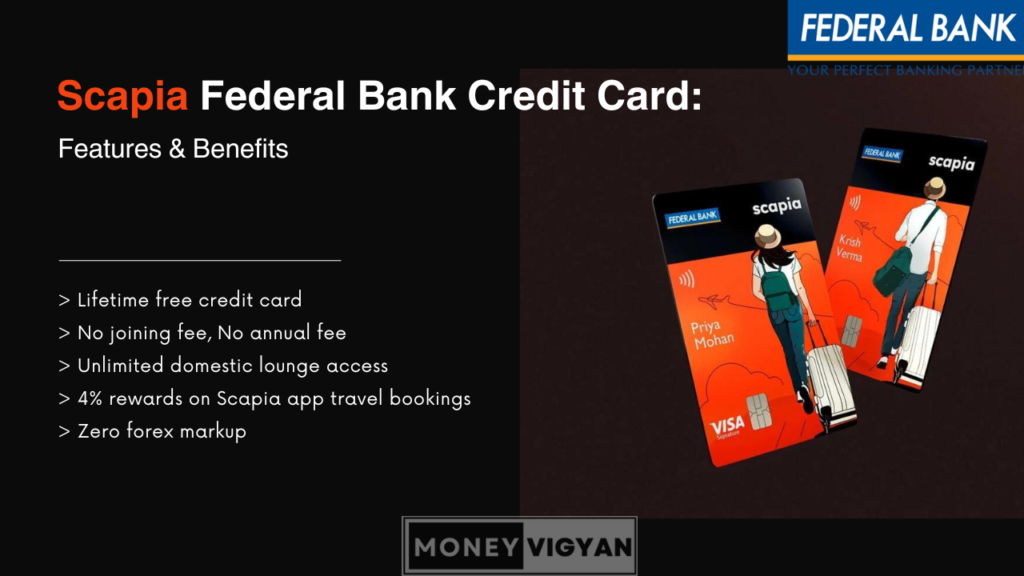

Scapia Federal Bank Credit Card is a great option for people who are looking for a no-annual-fee credit card with good rewards. It is a co-branded credit card being offered by the federal bank and fintech Scapia.

It offers 2-4% cash back on purchases, which can be redeemed for statement credits, gift cards, or travel.In this blog post, we will take a closer look at the Scapia Federal Bank Credit Card and see if it is the right card for you. We will discuss the card’s features, benefits, and drawbacks, and help you decide if it is the right card for your needs.

Let’s get started!

Overview

| Type | Rewards Credit Card |

| Card network | VISA |

| Reward Rate | Upto 2 -4 % |

| Annual Fee | 0 |

| Best use | 20% Scapia coins on travel bookings done on the Scapia App |

| Best Feature | Zero forex markup on all international transactions |

| Helpline number | +91 8048675100 |

Eligibility for Scapia Federal Bank Credit Card

If you happen to already own another Federal Bank credit card or have taken out a personal loan with them, I’m sorry to say that you won’t be eligible for the Scapia co-branded credit card. The same rule applies if you’re rocking the OneCard that’s linked up with Federal Bank.

It’s all because of Federal Bank’s one-card policy, which, I know, can be a bit of a buzzkill. Let’s hope they decide to loosen up on that rule in the future!

Also Read: IndusInd pinnacle credit card review

Documents Required

- Identity proof: Aadhar card, PAN card, Voter card slip, driver’s license.

- Address proof: Ration card, water bill, gas connection bill, electric bill.

- Income proof: Form 16 or last 2 months’ payslip.

How To Apply for Scapia Credit Card

To obtain a Scapia Credit Card, follow these easy steps:

- Download and install the Scapia application on your smartphone.

- Complete the KYC (Know Your Customer) process using your Aadhaar and PAN (Permanent Account Number). Video KYC may also be required for certain users.

- Once your application is approved, you will receive an instant virtual Scapia card for seamless online transactions.

- Your physical Scapia Credit Card will be delivered within 2 – 3 days and can be tracked using the mobile application.

Also Read: ICICI Coral RuPay Credit Card: Benefits, Fees, and More

Fee and charges

| Fee Type | Fee Amount (INR) |

| Joining Fee | Nil |

| Renewal Fee | Nil |

| Welcome Benefit | No welcome benefit |

| Add-on Card Fee | NA (Currently Add-on facility is not offered) |

| Cash Withdrawal Fee | 2.5% or ₹500, whichever is higher |

| Interest on Cash Advance | 3.49 % per month |

| Card Replacement Fee | ₹ 200 |

| Reward Point Redemption Fee | Nil |

| Renewal Benefit | Nil |

| Renewal Fee Waiver | NA |

Late payment fee

Cardholders should try to pay the complete due amount before the bill date. If you can’t pay the complete amount by the due date, interest charges as well as a late payment fee will be applied by the bank. Moreover, GST will also be added upon interest charges and late payment fee. These late payment charges shall be as follows:

| Balance amount | Late Payment Charge (Rs.) |

| Less than Rs. 100 | 0 |

| Rs. 100 – Rs. 500 | 100 |

| Rs. 501 to Rs. 5000 | 500 |

| Rs. 5001 to Rs. 10000 | 600 |

| Rs. 10001 to Rs. 25000 | 750 |

| Rs. 25001 to Rs. 50000 | 950 |

| More than Rs. 50000 | 1000 |

Also Read: Axis bank miles and more credit card: A complete review

Benefits and rewards

- This card is a lifetime free credit card.

- 20% Scapia coins on travel bookings done on the Scapia App.

- 10% Scapia coins on every eligible online and offline spends.

- Zero forex markup on all international transactions

- Unlimited domestic lounge access on a minimum spend of ₹5k.

- No Cost EMI for Travel Transactions on Scapia App (Feature Coming Soon):

- Eligibility: This incredible benefit will be exclusively available to Scapia Federal Credit Card holders.

- Applicable Transactions: You can avail of the No Cost EMI facility when booking flights or hotels through the Scapia App, with the option to convert your transaction into an EMI.

- EMI Tenure: No Cost EMI will be applicable for EMI transactions with a selected tenure of 3 months. Unfortunately, for terms of 6, 9, and 12 months, the No Cost EMI feature will not apply.

- Interest Charges: While interest charges will apply based on standard interest rates, here’s the exciting part – Scapia will credit an amount equivalent to the monthly interest levied on your Credit Card back to your account. This means you won’t incur any additional costs, making it genuinely “no-cost” for you, our valued customers.

- Cost Subvention: The No Cost EMI benefit covers explicitly the interest cost imposed by the Bank. Please note that a Processing Fee, as applicable, will be charged for converting your transaction into an EMI facility.

- Domestic lounge access

- You will get unlimited access to domestic lounges but there are some conditions to use this facility.

- You must spend Rs. 5000 in a billing cycle to unlock this facility.

- You should also be Active on a monthly basis to retain the Unlimited Domestic Lounge free access.

- Unlimited Lounge Access will be enabled in 5 working days post the Billing Date if the customer is eligible for the Access.

- You can see the list of domestic lounges participating in this program here.

- Excluded transactions: Scapia Coins will not accrue for money transfers, rent payments, cash withdrawals, EMI transactions, forex transactions, education and school fees, gift cards, credit card repayments, crypto/digital asset transactions, fuel surcharge and digital wallet loading or top-up transactions.

Currently, Scapia coins are valued at 5 Scapia coins = Rs. 1.

The Scapia Mobile Application: a full-fledged travel platform

You can control the Scapia Federal Credit Card entirely from the Application, some of the actions being:

- Setting your App PIN;

- Activating your Scapia Federal Credit Card;

- Making Credit Card bill payments;

- Managing your virtual Credit Card;

- Controlling your Credit Limit and cash withdrawal limit;

- Enabling online, Domestic Usage and International Usage;

- Setting your Scapia Federal Credit Card PIN (For use at Point of Sale and ATMs);

- Raising disputes or service queries on any aspect of your Scapia Federal Credit Card.

Comparison of Scapia credit card with other credit cards

Below is a travel and rewards comparison between the Scapia Federal Bank Credit Card and other co-branded travel credit cards, including the MakeMyTrip ICICI Platinum Credit Card, Axis Vistara Credit Card, and Air India SBI Platinum Credit Card.

| Credit Card | Scapia Federal | MMT ICICI Platinum | Axis Vistara | Air India SBI Platinum |

|---|---|---|---|---|

| Joining Fee | Nil | Rs. 500 | Rs. 1,500 | Rs. 1,499 |

| Renewal Fee & Fee Waiver | Nil | Nil | Rs. 1,500 | Rs. 1,499 |

| Welcome Gift | NA | Up to 5,000 reward points | Economy ticket, Vistara Base membership | 5,000 reward points, Air India Frequent Flyer membership |

| Base Reward Rate | 10 Scapia Coins per Rs. 100 spent (5 Scapia Coins = Rs. 1) | 1 My Cash per Rs. 200 domestic spends (1 My Cash = Rs. 1) | 2 CV points per Rs. 200 spent | 2 reward points per Rs. 100 spent |

| Accelerated/Travel Rewards | Unlimited domestic lounge access on Rs. 5,000 spent per month | 1.25 My Cash per Rs. 200 international spends; 2 My Cash on flight & 3 My Cash on hotel spends via MMT | NA | 15 points per Rs. 100 spent on Air India booking centres for self & 5 points per Rs. 100 spent for others |

| Forex Mark-up | Zero | 3.5% | 3.5% | 3.5% |

| Milestone Benefits | Unlimited domestic lounge access on Rs. 5,000 spends per month | 1,000 My Cash on Rs. 50,000 annual MMT spends; 1,000 My Cash on Rs. 2.5 lakh annual spends | 20 Scapia Coins per Rs. 100 travel spends on the Scapia app | 5,000 reward points on Rs. 2 lakh annual spends; 10,000 reward points on Rs. 3 lakh annual spends |

| Lounge Access | Spend-based lounge access | Domestic airport & railway lounge access | 2 domestic lounge access per quarter | 1,000 CV Points on Rs. 50,000 spent within the 1st 90 days; Economy tickets on Rs. 1.25 lakh, Rs. 2.5 lakh & Rs. 6 lakh annual spends |

Should you apply for the Scapia Credit card?

The Scapia Credit Card is a wonderful option for people seeking a lifetime-free card that offers a lot of travel-related benefits. Its standout feature, zero forex charges on international transactions, typically associated with premium or super-premium cards, is its USP. However, it’s worth noting that Scapia Coins cannot be earned on international transactions, which may be a drawback for frequent international travellers.

Beyond its forex advantage, the Scapia Credit Card offers accelerated travel rewards, with a generous 20% return in Scapia Coins. Additionally, cardholders can enjoy unlimited access to domestic lounges by simply spending Rs. 5,000 per month, a target easily attainable for many. Notably, there are no restrictions on the number of Scapia Coins you can accumulate, making it particularly attractive for high spenders who can maximize their returns.

Moreover, the card extends the convenience of converting travel expenses into manageable monthly EMIs. In a market where most travel credit cards impose substantial annual fees, Scapia presents a compelling alternative with its lifetime-free feature and robust travel-centric perks. What sets it apart is the seamless integration with the Scapia App, allowing cardholders to use Scapia Coins for hassle-free travel bookings. This streamlines the redemption process, making it an ideal choice for frequent travellers.

Consider applying for the Scapia Credit Card if:

- You frequently travel both within and outside India.

- You are a high spender and can make the most of the rewards on domestic expenses.

- You already possess credit cards tailored to other categories like shopping or dining, as the Scapia card primarily focuses on travel benefits.

What is the fee of the Scapia credit card for withdrawing cash from an international ATM?

On cash withdrawal from international ATMs using this card, you’ll incur a cash advance fee. This fee is calculated at 2.5% of the withdrawn amount or a minimum of Rs. 500, whichever is higher. Additionally, interest will be charged on the withdrawn amount at a rate of 41.88% per annum or 3.49% per month, starting from the date of the cash withdrawal until you’ve paid the full amount. It’s worth noting that there won’t be any forex markup fee applied in this case.

What is the criteria for unlimited domestic lounge access on the Scapia credit card?

To enjoy unlimited domestic lounge access you must spend at least Rs. 5000 in the previous billing cycle. To be able to continue using this benefit all year long, you must spend a minimum of Rs. 5,000 every month.

3 thoughts on “Scapia Federal Bank Credit Card: Features and Apply online”