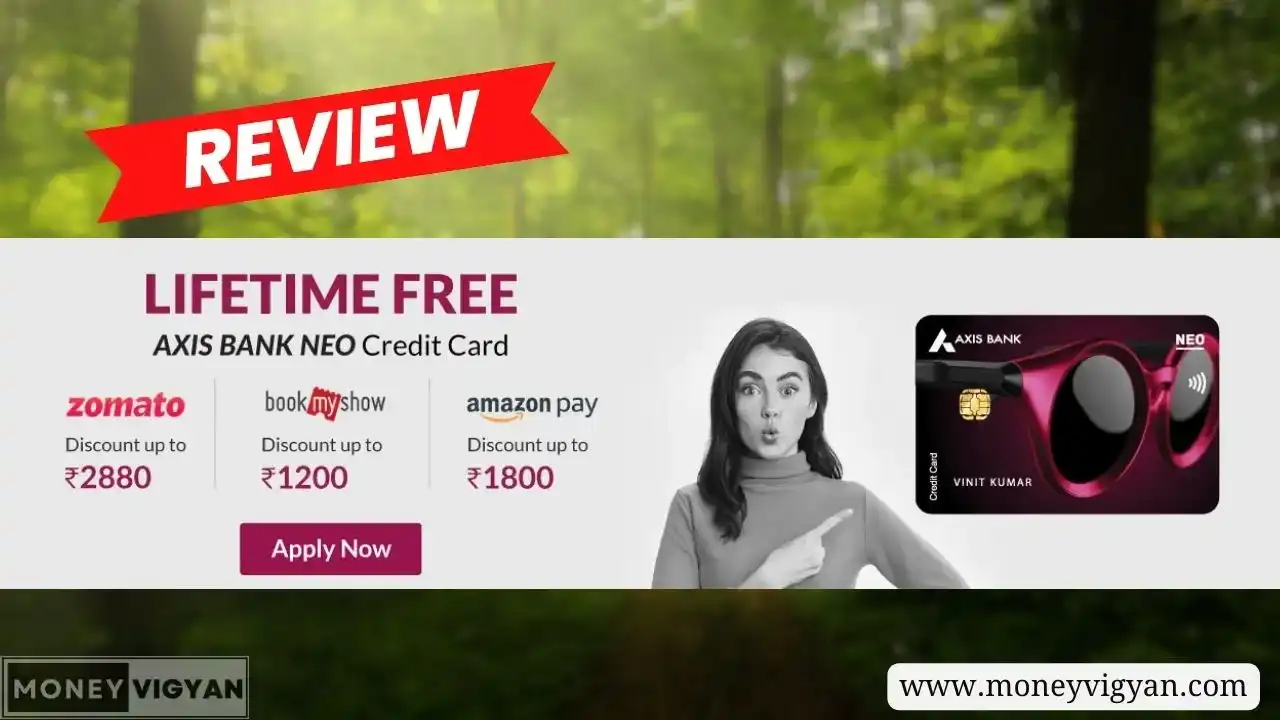

The Axis Neo Credit Card is a great option for frequent online shoppers, as it offers a variety of benefits on online transactions, including discounts on popular brands like Amazon, Zomato, Myntra, and BookMyShow. The card also comes with a low annual fee, making it a good value for the price.

If you’re looking for a credit card that can help you save money on your online purchases, the Axis Neo Credit Card is a great option to consider. In this blog post, we’ll take a closer look at the card’s features and benefits, and help you decide if it’s right for you.

Let’s get started!

Overview

| Type | Rewards Credit Card |

| Card network | MASTERCARD |

| Reward Rate | Upto 0.5 – 1 % |

| Annual Fee | 250 + GST |

| Best use | Booking movie tickets and ordering food online |

| Best Feature | 40% off on Zomato |

| Helpline number | 18605005555 and 18604195555 |

Axis Bank Neo credit card: Benefits and rewards

- Movie & Dining Discounts:

- BookMyShow: You can get a 10% discount when booking movie tickets on BookMyShow. The limit of this discount is Rs. 100 per month. The Offer is valid only till 31st March 2024.

- Zomato: You can also enjoy a 40% discount on food delivery when ordering through Zomato. The maximum discount limit is Rs. 120. The order should be more than Rs. 200. You can avail of such a discount twice a month. The monthly limit of this discount is Rs. 240.

- Online shopping discounts:

- Myntra: you get an extra 10% discount when making a minimum transaction of Rs. 500 on select styles when shopping on Myntra. Catalog link: https://myntraapp.onelink.me/1L28/neo10. This offer is valid only till 31st Dec 2023.

- Blinkit: 10% off up to Rs. 250 on a minimum transaction value of Rs. 750, valid once per card per month. To avail this offer use code: AXISNEO

- Rewards Rate:

- You earn 1 EDGE REWARD point for every Rs. 200 spent using your credit card.

- You can redeem your Edge Reward points on the Edge Rewards Website at a rate of 1 Edge RP (Reward Point) = Re. 0.20.

- Dinner delights:

- 15% off up to Rs.500 on a minimum Order Value of Rs.2500. Valid once per card per month.

- Domestic Lounge Access:

- This credit card does not offer access to domestic airport lounges.

- Insurance Benefits:

- There are no specific insurance benefits listed for this credit card.

- Zero Liability Protection:

- This feature provides protection against any unauthorized or fraudulent use of your card, as long as you report the loss or theft of your card to the bank promptly.

Also Read: Scapia Federal Bank Credit Card: A 2023 Guide

Fee and charges

| Fee Type | Fee Amount (INR) |

| Joining Fee | Rs. 250 + GST (Waived off if Rs.2,500 spent in 45 days) |

| Renewal Fee | Rs. 250 + GST |

| Add-on Card Fee | NIL |

| Cash Withdrawal Fee | 2.5% or ₹500, whichever is higher |

| Interest on Cash Advance | 3.49 % per month |

| Card Replacement Fee | Nil |

| Reward Point Redemption Fee | Nil |

| Renewal Benefit | Nil |

| Renewal Fee Waiver | NA |

Late payment fee

Cardholders should try to pay the complete due amount before the bill date. If you can’t pay the complete amount by the due date, interest charges as well as a late payment fee will be applied by the bank. Moreover, GST will also be added upon interest charges and late payment fees. These late payment charges shall be as follows:

| Balance amount | Late Payment Charge (Rs.) |

| Less than Rs. 500 | 0 |

| Rs. 500– Rs. 5000 | 500 |

| Rs. 5,001 – Rs. 10,000 | 750 |

| greater than Rs.10,000 | 1200 |

Eligibility for Neo credit card

The criteria of eligibility for Neo Credit Card are that the primary cardholder must be a Resident of India or a Non-Resident Indian, between the age of 18 and 70 years; while the add-on cardholder should be over 15 years of age.

Individuals eligible for Axis Bank Neo Credit Card:

- Primary cardholder should be between the age of 18 and 70 years

- Add-on cardholder should be over 15 years

- The individual should either be a Resident of India or a Non-Resident Indian

Also Read: IndusInd pinnacle credit card review

Documents required for Neo credit card

The following documents are required for the application of Neo credit card:

- PAN card photocopy or Form 60

- Colour photograph

- Latest payslip/Form 16/IT return copy as proof of income

- Residence proof (any one of the following):

- Passport

- Ration Card

- Electricity bill

- Landline telephone bill

- Identity proof (any one of the following):

- Passport

- Driving license

- PAN card

- Aadhaar card

Additional resources

Conclusion

This card is focused on the younger generation who spend a lot on moving books, ordering food online, and online shopping. While giving upfront discounts on Zomato, BookMyShow, Blinkit, etc, it also gives you EDGE rewards which you can redeem later.

While it doesn’t offer domestic airport lounge access, it is still a decent entry-level credit card for youngsters.

Please share your opinion on the Axis Bank Neo Credit Card in the comments section below.

What is the joining and annual fee for neo credit card?

The joining and renewal fee for this credit card is Rs. 250.

Is lounge access available for this credit card?

No domestic or international airport lounge access is available for this credit card.

What is the eligibility criteria for neo credit card?

1. Primary cardholder should be between the age of 18 and 70 years

2. Add-on cardholder should be over 15 years

3. The individual should either be a Resident of India or a Non-Resident Indian

What is the maximum limit for Axis bank neo credit card?

There is no fixed upper limit for this credit card, however, the actual credit limit offered to you will be at the discretion of the bank and will depend on a number of factors, including your credit history, credit score, and income.

1 thought on “Axis Bank Neo credit card review: Features, benefits and charges”