Introduction

Have you ever heard the story of Abhimanyu? He was a warrior in Indian mythology, skilled in battle tactics, except for one. Abhimanyu knew how to enter the “chakravyuh,” a complex formation of soldiers in battle, but he didn’t know how to exit it. Similarly, many investors know how to enter the stock market, but they struggle when it comes to exiting their investments. They hold onto losing stocks for too long, hoping for a rebound, only to watch their hard-earned money disappear. sometimes they fail to sell their stock while they are in profit.

In this post, I’ll share some tips and methods on confidently exiting the “chakravyuh” of the stock market and avoiding the blowout of the portfolio.

Why do you need to sell

This quote by legendary investor Peter Lynch sums up the necessity of selling the stock.

Once in a while, you must have experienced one or both of the following scenarios in the stock market:

Scenario 1:

You’re eagerly watching as the stock market unfolds, and you finally make the decision to invest in a particular stock. At first, everything seems to be going well. The stock is going up – but suddenly, the stock begins to take a plunge. Your initial optimism quickly turns to despair as you hope for the stock to recover, just enough to at least break even.

Just when you think things might be looking up, the stock takes yet another nosedive, leaving you feeling frustrated and discouraged. In an attempt to bring down your average buying price, you make the decision to purchase more shares. And for a brief moment, it seems like your strategy might pay off.

But alas, it’s not meant to be. The stock plummets once again, leaving you feeling like you’re stuck in a never-ending cycle of disappointment. Yet still, you refuse to give up hope. You average down your stock on a little bounce, believing that you’ve finally caught the bottom of the stock.

But then, disaster strikes. The stock takes a sudden, massive nosedive, leaving you with significant losses and a heavy heart. Finally, you decide to cut your losses and sell off your shares, feeling defeated and disillusioned.

Scenario 2:

After watching a stock for some time or on a suggestion from social media recommendations you finally bought the stock, and your chosen stock begins to soar. As you watch your stock going up you feel good about making that wise investment decision.

You are in no mood to sell to lock in your profits. After all, the stock is still climbing higher and higher, and you can’t help but think that there’s even more money to be made. Days turn into weeks, and weeks turn into months. The stock continues to rise, and you are riding the trend nicely but still have no thought of selling because you are convinced that you can make even more profit. Analysts are giving higher and higher profit targets on TV. But suddenly defying all analysis, the market takes a U-turn, and the stock starts to fall.

As it begins to fall, panic sets in, and you realize that you’ve missed your chance to secure your gains. You watch as the stock gives up all the progress it made, and then some. Your once-impressive profits have now vanished, and you’re left with nothing but regret. You are now hoping that just once stock touches its old high, so that you can take your profits that have only been on paper so far.

It serves as a warning by showing us how often greed can leave us oblivious to market reality. As investors, we must practise discipline and vigilance, keep a cool head at all times, and lock in our gains when the time is right.

When to sell

Stock market investing can be lucrative, but there are risks involved. Choosing when to sell a stock is one of the most important decisions that investors must make. Both novice investors and expert investors may find it difficult to make this choice. But some situations can indicate that it’s time to sell a stock. We’ll look at a few of the most popular reasons for selling stocks.

Change in the fundamentals of the company

If the fundaments of the company are deteriorating, for example falling revenues, incresting debt, falling profit margins, etc then there is no reason to stay in the stock. If the management keeps on revising its targets to the lower side then it is also one of the flags to consider for selling the stock before the stock starts falling.

The stock has reached its target price

If you have bought the stock based on technical analysis such as cup and handle breakout, Fibonacci level-based trades, the breakout from the base, pole and flag breakout, etc. then generally in such cases there is a pre-defined target. If the stock hits this target then you should exit from that stock. Do not stay in hope of stock going up further, it is always better to have a clean exit.

The market has become overvalued

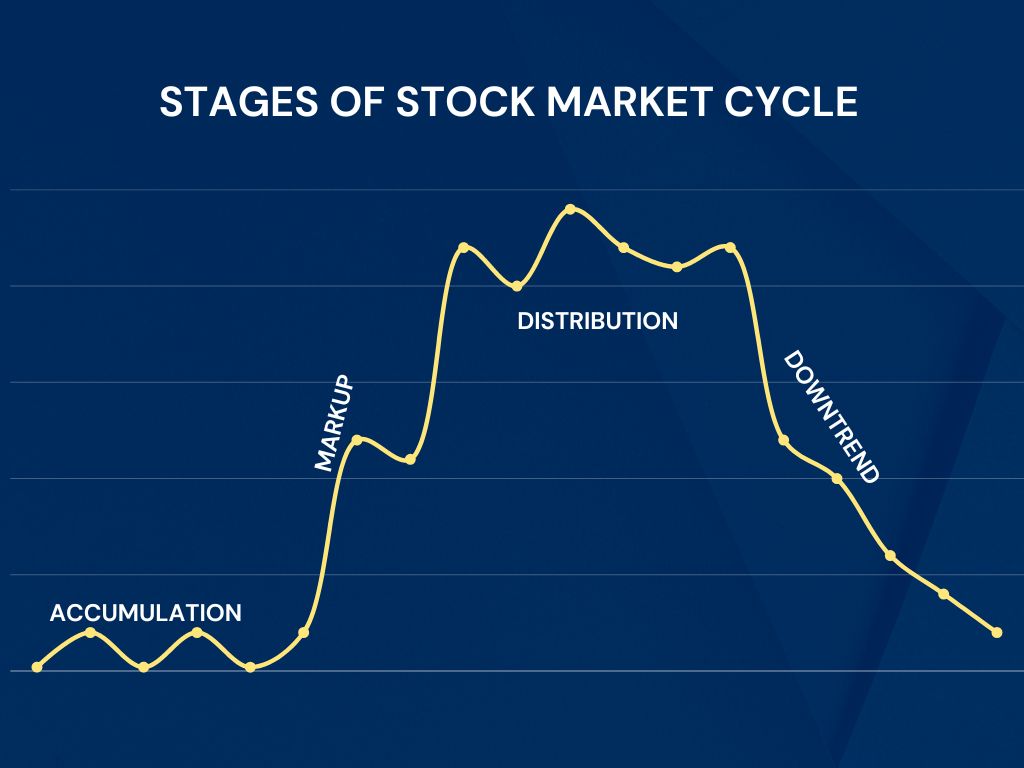

The stock market moves in cycles. There are 4 phases in each cycle:

- Accumulation Phase: Accumulation occurs after the market has bottomed and the innovators and early adopters begin to buy, figuring the worst is over. At this stage, most stocks are undervalued as there is fear among market participants.

- Mark-up Phase: This occurs when the market has been stable for a while and moves higher in price. In this phase stocks move upwards and there is joy among market participants.

- Distribution Phase: Sellers begin to dominate as the stock reaches its peak. At this stage, the market starts to move in a sideways channel. Most retail traders fail to recognise this stage. They keep on holding their stocks in hope that the market will keep on going higher and higher. At the distribution phase, you should get out of the market.

- Downtrend: A downtrend occurs when the stock price is tumbling down.

Personal financial needs

Sometimes investors might need money to pay for some significant expenses such as medical expenses, and a down payment for a home loan. In such a situation, the investor has to sell a stock. Another scenario will be where the investor is nearing retirement and need to rebalance his portfolio, he has to sell the stocks in his portfolio and rebalance it as per his requirement.

Stock is going into loss

If after buying the stock it is going down then rather than holding onto it in hope of a rebound and turning into a profitable position, it is always better to clearly exit this position. If you want to be successful in the stock market then you have to learn to cut your losses quickly and let your winner run with a trailing stop loss.

The art of selling

In this section, we are going to look at some actionable strategies that will help you in exiting your portfolio positions with maximum profits or with minimum losses.

In the scenario-1 we have discussed above investor has made two critical mistakes:

- Not having a predefined stop loss when initiating the first buying position

- Averaging down the stock

If he had a 7% stop loss when initiating the first buying position he would have been saved from the massive loss that followed afterwards. For retail traders, it would be beneficial to put their stop-loss orders in the system so that it gets executed automatically as soon as the stop-loss price is reached.

Averaging down a falling stock is absolutely detrimental to your portfolio. You should never ever do it.

In the scenario-2 type situation, it is always good practice to move your stop loss up as the stock moves up. There can be several rules on how to move SL up some can be as below:

- Fix percentage: for every 10% up move of stock you will move your SL up by 10%

- Swing low: if the stock is moving higher high-higher low pattern then you can use swing lows as stop loss.

- Moving average: you can use a simple or exponential moving average as a trailing stop loss.

- Candlestick low: if the stock is moving too fast then you can use the low of the candlestick for trailing your stop-loss.

Conclusion

In conclusion, selling stocks is an essential part of any investment journey. While you might have heard about the advice of ‘Buy and hold forever’, this advice suits only those who have sound acumen for analyzing business valuation and tracking the developments across segments of the business. It is critical for retail traders to realise that selling is equally as vital as buying. Knowing when to sell is critical, and understanding why and how to sell can make or break your investment gains.

If you follow the guidelines and strategies discussed in this guide, you can confidently sell your stocks with ease. Whether it’s to lock in profits, minimise losses, or simply to rebalance your portfolio.

So, don’t be afraid to take action, don’t get married to your stock and make the tough decisions when it comes to selling your stocks. With the right knowledge and mindset, you can make informed and profitable choices that will set you on the path to financial success. Happy selling!

FAQs:

What are the top 5 reasons to sell a stock?

1. Change in the fundamentals of the company

2. The stock has reached its target price

3. The market has become overvalued

4. Personal financial needs

5. Stock is going to loss

Should I sell a stock at loss?

Cut your loss if the stock falls 7% to 8% below your purchase price. But can you do better than that? If you can find clues that the stock isn’t acting right, then get out with a smaller loss.

Why do 95% of traders lose money?

The most common mistakes that are committed by traders are averaging your losing positions, not doing research, overtrading, not keeping records of your journal and following too much on recommendations.