Juniper Hotels is all set for its IPO, set to raise Rs. 1800 Cr, commencing on February 21, 2024, and concluding on February 23. The company plans to debut on the exchange on February 28, 2024. In this review we will look into Juniper Hotels Limited’s IPO for 2024, examining its merits and drawbacks in detail. Stay tuned for insights!

Juniper Hotels IPO: Introduction

About the Company

Juniper Hotels, a leading company in the luxury hotel industry, stands out as the largest owner of Hyatt-affiliated properties in India. Here’s a closer look at its offerings:

- Portfolio:

- Owns and develops luxury hotels and service apartments.

- Boasts a portfolio of 7 hotels and service apartments.

- Operates over 1836 keys across its properties.

- Geographical Presence:

- Spread across major cities such as Mumbai, Delhi, Ahmedabad, Lucknow, Raipur, and Hampi.

- Each location offers unique experiences and amenities.

- Ownership and Structure:

- Jointly held by Saraf Hotels and Two Seas Holding Holdings, an indirect subsidiary of the Hyatt Group.

- Benefits from the expertise and resources of both partners.

- Flagship Properties:

- Features two luxury hotels: Grand Hyatt Mumbai Hotel and Andaz Delhi.

- Offers a premium experience synonymous with the Hyatt brand.

- Upper Upscale and Upscale Offerings:

- Presents four upper upscale hotels:

- Hyatt Delhi Residences

- Regency Ahmedabad

- Regency Lucknow

- Hyatt Raipur

- Operates one upscale hotel: Hyatt Place Hampi.

- Presents four upper upscale hotels:

- Property Size and Segmentation:

- Spans a total of 1.43 lakh square feet in commercial areas.

- Occupies 1.05 lakh square feet in the MICE (Meetings, Incentives, Conferences, and Exhibitions) segment.

Juniper Hotels caters to various traveller preferences, whether for business or leisure, with its diverse range of properties and strategic locations.

About the Hotel Industry in India

Here’s a breakdown of key insights about the hotel industry in India:

- Room Supply:

- Currently stands at 1.7 lakh hotel rooms as of FY23.

- Experienced robust growth between FY08 and FY15, with a 15% CAGR.

- The growth rate stabilized at 6.1% CAGR from FY16 to FY23.

- Expected to add approximately 60,000 rooms from October 2023 to March 2027.

- Segment Concentration Shift:

- Luxury and upper upscale segments are seeing a dilution, leading to increased demand for the upscale segment.

- Around 25% of new supply is projected to come from the luxury and upper upscale segments.

- 24% from upscale, 20% from upper midscale, and 31% from midscale economy class.

- Foreign Trade Arrivals (FTA):

- FTA reached a peak in FY19 before declining sharply in FY20 due to the pandemic.

- Demand has rebounded to 87.5% of FY24 levels.

- FY23 witnessed strong growth compared to FY19, driven by pent-up corporate and MICE travel demand.

- Expecting continued growth in FY24 before a slowdown in early FY25 due to elections.

- Long-term FTA demand grew at a CAGR of 9.8% from FY08-23 and is projected to grow by 11% in FY26 & FY27.

- Drivers of Industry Growth:

- Greater demand is expected from MICE travel and leisure travel segments.

- Weddings and other social events are also anticipated to drive significant demand for the segment.

The Indian hotel industry is poised for growth, driven by various factors including changing segment dynamics and evolving travel patterns.

Also Read: Best RuPay Credit Cards in India 2024

Key Details of Juniper Hotels IPO

| Details | Information |

|---|---|

| Dates | |

| Subscription Opens | February 21st, 2024 |

| Subscription Closes | February 23rd, 2024 |

| Listing (tentative) | February 28th, 2024 |

| Issue | |

| Type | Fresh issue only |

| Size | ₹1,800 Crore (5 Crore Equity Shares) |

| Price Band | ₹342 – ₹360 per share |

| Minimum Investment | ₹14,400 (40 shares) |

| Lot Size | 40 Shares |

| Listing | |

| Exchanges | BSE & NSE |

Promoters: Arun Kumar Saraf, Saraf Hotel Ltd, Two Seas Holding Ltd and Juniper Investments Ltd

Book Running Lead Manager: JM Financial Ltd., CLSA India Pvt Ltd and ICICI Securities Ltd.

Registrar to the Offer: KFintech Ltd

The Objective of the Issue:

The company aims to utilize Rs. 1500 Cr of the net proceeds to repay the loan acquired during the recent acquisition of CHPL and CHHPL. The remaining funds will be allocated towards general corporate purposes.

Financials of Juniper Hotels

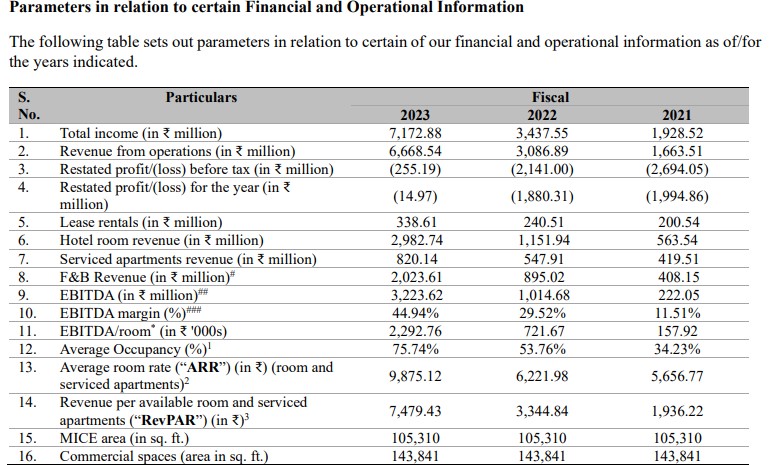

Juniper Hotels demonstrated impressive performance in FY23, characterized by significant improvements across key metrics:

Occupancy Surge:

- Achieved an average occupancy rate of 76%, a remarkable increase from 54% in FY22, reflecting a gain of nearly 2200 basis points.

- Presently maintains a robust average occupancy rate of 74.84%.

Revenue Growth:

- Revenue per Available Room (RevPAR) surged to Rs. 9875 in FY23, showing consistent growth from Rs. 5657 in FY21, translating to a notable compounded annual growth rate (CAGR) of 32%.

- Revenue composition reveals that 48% of earnings come from hotel rooms, 33% from the food and beverage segment, and 13% from service apartments.

Juniper’s financial performance also saw significant strides:

Revenue Expansion:

Reported an impressive revenue from operations of Rs. 667 Cr in FY23, marking a substantial 116% increase from Rs. 309 Cr previously.

Also Read: EazyDiner IndusInd Bank Platinum Credit Card: Full Review

Profitability Challenges:

- Despite revenue growth, the company has yet to achieve profitability, reporting consecutive losses over the past three fiscal years.

- Net losses narrowed down from Rs. 199 Cr in FY21 to Rs. 1.49 Cr in FY23.

Debt Dynamics:

- Incurred considerable finance costs, totaling approximately Rs. 26.6 Cr, to service significant borrowings.

- Eliminating debt from its balance sheet would potentially facilitate a break-even scenario for the company in FY23.

- Currently holds long-term borrowings amounting to Rs. 2009 Cr, with the debt burden witnessing a notable 7% CAGR from FY21-23.

Strengths and Weaknesses of Juniper Hotels IPO

Strengths:

- Expertise in site selection and hotel development opportunities: Juniper Hotels strategically places its properties in key Indian cities, targeting upscale travelers and ensuring long-term returns by selecting prime locations and aligning with suitable Hyatt sub-brands.

- Strong asset management focuses on improving efficiency and profitability: Juniper Hotels has established specialized asset management teams with functional clusters for operations, finance, HR, procurement, and sales, enabling the application of best practices and maximizing results.

- Primed to capitalize on industry trends: India’s robust economic growth, forecasted increase in per capita GDP, expanding middle class, and rising household incomes all point to significant demand for upper-tier hotels in the coming years.

Also Read: HDFC Bank UPI RuPay Credit Card: Full Review

Weaknesses:

- Revenue concentration: With over 50% of revenues derived from the Grand Hyatt Mumbai Hotel and around 90% of revenue originating from just three hotels in the Mumbai & Delhi region, any slowdown in this specific area can significantly impact operations.

- Loss-making status: Juniper Hotels has recorded losses over the past three financial years, coupled with a debt to equity ratio of 3.1 times as of September 30, 2023, necessitating the need for additional capital to support further expansion.

- Operating in a highly competitive industry: Juniper operates within a fiercely competitive landscape, adding pressure to maintain profitability and market share amidst stiff competition.

SWOT Analysis of Juniper Hotels IPO

| Strengths | Opportunities | Weaknesses | Threats |

|---|---|---|---|

| – Strong Hyatt Brand Partnership | – Growing Indian Tourism Market | – High Debt Levels (3.1x Debt-to-Equity Ratio) | – Intense Competition in Indian Hospitality Industry |

| – Luxury Focus in High-Growth Segment | – Expansion into New Cities & Segments | – Unproven Track Record with Short Operating History | – Economic Downturn Impacting Travel Spending |

| – Prime Locations in Key Cities | – Increased Occupancy Rates through Efficiency & Marketing | – Revenue Concentration in Few Key Hotels | – Potential Changes in Government Policies |

| – Fresh IPO Proceeds for Expansion & Debt Reduction | – Digitalization for Enhanced Guest Experience & Reach | – Consistent Losses in Past 3 Years Raising Profitability Concerns | – Global Travel Disruptions (Pandemics, Geopolitics) |

| – Award-Winning Service & Quality Commitment | – Strategic Partnerships for Growth | – Limited Brand Diversity (Sole Reliance on Hyatt) | – Rising Operational Costs (Labor, Materials, Utilities) |

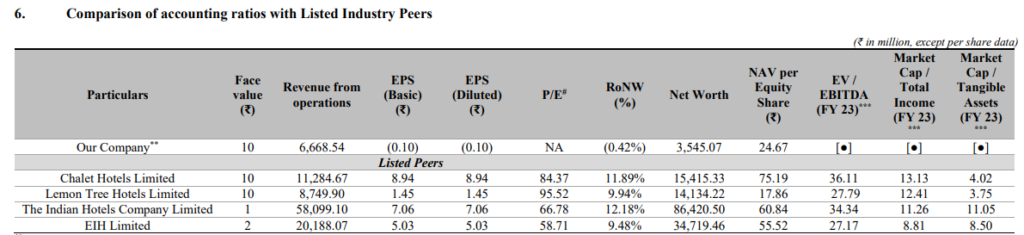

Peer Analysis

While JHL shows potential with its revenue growth and brand association, its lack of profitability, smaller portfolio, and high debt, raise concerns. Compared to peers, it has a weaker financial position and needs to demonstrate sustained profitability to justify its valuation. Investors should carefully consider these factors before making any investment decisions.

Juniper Hotels IPO GMP Today

Juniper Hotels’ upcoming IPO is generating significant buzz, with the grey market premium (GMP) indicating investor appetite pushing the potential listing price above the offered range.

Juniper IPO GMP today or grey market premium is Rs. 8. Analysts predict shares could debut at ₹368, a 2.22% jump from the top end of the IPO band, reflecting optimism in the market.

This pre-listing trading activity suggests potential strong demand for the shares, but it’s crucial to remember that the GMP is not a guaranteed indicator of the actual listing price. As always, thorough research and individual assessment are essential before making any investment decisions.

Also Read: How to create the best mutual fund portfolio

How to check Juniper Hotels IPO Allotment status?

Check Juniper Hotels IPO allotment status on KFin Technologies website allotment URL. Click Here

FAQs

What is Juniper Hotels IPO?

Juniper Hotels’ IPO, classified as a main-board IPO, aims to raise ₹1800 Crores. The offering is priced at ₹342 to ₹360 per equity share, and the company intends to list on both the BSE and NSE.

When Juniper Hotels IPO will open?

The IPO is to open on February 21, 2024 for QIB, NII, and Retail Investors.

What is Juniper Hotels IPO Investors Portion?

The investors’ portion for QIB is 75%, NII is 15%, and Retail is 10%.

What is Juniper Hotels IPO Price Band?

Juniper Hotels IPO Price Band is ₹342 to ₹360.

What is the Juniper Hotels IPO Allotment Date?

Juniper Hotels IPO allotment date is February 26, 2024.