About the Company

- Jyoti CNC Automation is a name synonymous with precision and innovation in the world of metal cutting. Established in 1991, the company has grown to become a leading manufacturer of Computer Numerical Control (CNC) machines in India, holding the second-largest market share domestically and ranking 12th globally.

- Since its inception, the company has grown manifold from manufacturing gear boxes for machines to developing precision all-geared head lathe machines. Later on, Jyoti has identified a shift from conventional machines to highly sophisticated CNC machines.

- The company competes at a global level and supplies CNC machines to Romania, France, Poland, Belgium, Italy, and the United Kingdom through Huron’s established dealer network and also has 29 sales and service centres.

- The company has plants located at GIDC, Metoda, RAJKOT – Gujarat, having a large capacity of manufacturing the machines equipped with a foundry, sheet metal shop, paint shop, sub-assembly and assembly lines, and a repair facility.

- ISRO and Tata Advanced System are also among its noted vendors.

- The Jyoti CNC Automation IPO is a good opportunity for investors to participate in the growth of the Indian aerospace market. The IPO is open for subscription from January 9 to 11, 2024.

Company Website: https://https://jyoti.co.in/

Primary Business of the company:

Jyoti CNC Automation occupies a prominent position in the global metal cutting CNC machine landscape. In India, the company stands tall as the third-largest player, capturing roughly 10% of the market share in the fiscal year 2023 (source: F&S Report). On a global level, Jyoti CNC ranks thirteenth, commanding a share of 0.4% in the calendar year 2022 (source: F&S Report). Within India, the company further cements its leadership by being the foremost manufacturer of simultaneous 5-Axis CNC machines. Jyoti CNC boasts a diverse portfolio of CNC machines, catering to various needs with offerings like turning centers, turn-mill centers, vertical and horizontal machining centers.

Also Read: This Small Cap share to split 1:2; record date fixed – Doubled money in 6 months

The products & services offered by the company:

Jyoti CNC Automation products and services include:

- CNC Turning / Turn Mill Centers

- CNC Vertical Machining Centers

- CNC Horizontal Machining Centers

- CNC 5 Axis Machining Centers

- CNC Multi Tasking Machines

The objective of Jyoti CNC Automation IPO:

The objective of the Jyoti CNC Automation IPO, as per the RHP, is to raise ₹1000 crores through a fresh issue of equity shares and an offer for the sale of existing equity shares.

The proceeds from the IPO will be used for the following purposes:

- Repayment of borrowing

- Funding long-term working capital requirements of the Company

- General corporate purposes

The IPO of Jyoti CNC Automation is being offered at a price band of Rs. 315-331 per share. The issue opens on January 9, 2024, and closes on January 11, 2024. The company is targeting to raise Rs. 1,000 crore through the IPO.

useful information

Jyoti CNC Automation IPO Lot Size

| IPO Activity | Date |

|---|---|

| Issue Price | 315-331 |

| Market 1 Lot: | 45 Shares |

| 1 Lot Amount: | 14895 |

| Min Small HNI Lots(2-10 Lakh): | 14 Lots |

| Min Big HNI Lots(10+ Lakh): | 68 Lots |

Jyoti CNC Automation IPO Dates

| IPO Activity | Date |

|---|---|

| IPO Open Date | 09-01-2024 |

| IPO Close Date | 11-01-2024 |

| Basis of Allotment Finalization Date* | 12-01-2024 |

| Refunds Initiation* | 15-01-2024 |

| Credit of Shares to Demat Account* | 15-01-2024 |

| IPO Listing Date* | 16-01-2024 |

Jyoti CNC Automation IPO Details

| IPO Issue Price: | 315-331 Per Share |

| DRHP: | Download DRHP |

| RHP: | Download RHP |

| IPO Listing At: | NSE, BSE |

| Retail Quota: | Not more than 10% of the Net Issue |

| IPO Issue Type: | Book Build Issue |

| IPO Issue Size: | ₹1,000 Cr |

| Fresh Issue: | ₹1,000 Cr |

| Face Value: | ₹2 Per Equity Share |

| Promoter Holding Pre IPO: | 72.66 % |

| Promoter Holding Post IPO: | – |

Key risks

The key risks associated with the Jyoti CNC Automation IPO include:

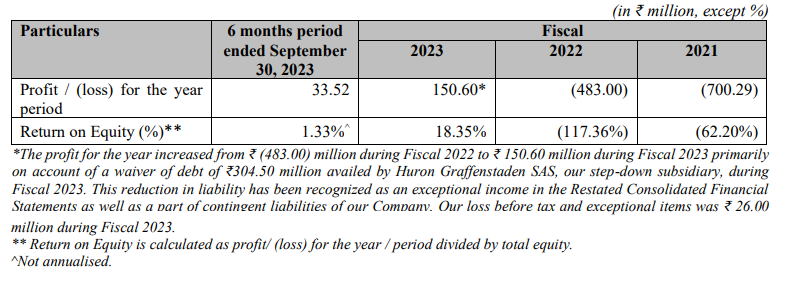

- Losses in past: Company has incurred losses and consequently, had a negative return on equity in the past.

2. Not long term contracts: By their very nature, though, CNC machines are not consumer products and, therefore, we do not, generally, have repeat customers on an annual

basis

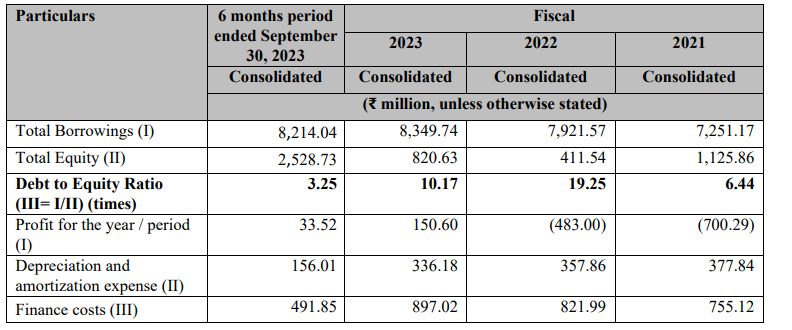

3. High debt: Comany has high debt currently and if they do not generate sufficient amount of cash flows from operations, our liquidity and our ability to service our indebtedness could be adversely affected.

4. The company has delayed in the payment of statutory dues in the past.

Also Read: Kaushalya Logistics IPO: How To Check Allotment Status Today? Know Latest GMP

Jyoti CNC Automation Past Financials

Jyoti CNC Automation Restated Consolidated Statement of Assets and Liabilities (in ₹ million)

| Particulars | As at September 30, 2023 | March 31, 2023 | March 31, 2022 | March 31, 2021 |

|---|---|---|---|---|

| ASSETS | ||||

| Non-current assets | ||||

| – Property, Plant and Equipment | 2,829.37 | 2,689.02 | 2,745.55 | 2,991.55 |

| – Capital work-in-progress | 150.30 | 82.79 | 8.97 | 510.89 |

| – Right of Use Assets | 0.06 | 0.06 | 0.36 | 0.86 |

| – Intangible assets | 130.30 | 141.60 | 179.12 | 219.75 |

| – Intangible assets under development | 83.61 | 71.01 | 45.81 | 26.37 |

| – Financial assets: – Investments | 34.76 | 33.88 | 19.58 | 18.55 |

| – Financial assets: – Other financial assets | 17.89 | 100.47 | 49.76 | 118.92 |

| – Other non-current assets | 263.26 | 240.78 | 243.89 | 107.76 |

| Total non-current assets | 3,509.55 | 3,359.61 | 3,293.04 | 3,994.65 |

| Current assets | ||||

| – Inventories | 8,683.49 | 8,199.19 | 6,340.41 | 6,447.06 |

| – Financial assets: – Trade receivables | 1,331.23 | 1,458.78 | 2,001.90 | 2,166.40 |

| – Financial assets: – Cash and equivalents | 86.05 | 160.92 | 24.44 | 101.15 |

| – Financial assets: – Other balances with bank | 209.19 | 121.97 | 201.21 | 123.47 |

| – Financial assets: – Loans | 31.17 | 59.30 | 48.51 | 47.22 |

| – Financial assets: – Other financial asset | 2,539.20 | 1,410.72 | 331.40 | 513.31 |

| – Other current assets | 628.45 | 336.38 | 587.25 | 488.66 |

| – Current tax asset (net of provision) | 42.32 | 46.94 | 34.20 | – |

| Total current assets | 13,551.10 | 11,794.20 | 9,569.31 | 9,887.27 |

| TOTAL ASSETS | 17,060.65 | 15,153.81 | 12,862.35 | 13,881.92 |

| EQUITY AND LIABILITIES | ||||

| Equity | ||||

| – Equity share capital | 391.51 | 329.29 | 294.79 | 294.79 |

| – Compulsory convertible preference shares entirely in Equity Nature | 3.93 | – | – | – |

| – Other equity | 2,133.29 | 491.35 | 116.74 | 831.07 |

| Total equity | 2,528.73 | 820.63 | 411.54 | 1,125.86 |

| Non-current liabilities | ||||

| – Financial liabilities: – Borrowings | 1,042.91 | 1,274.65 | 1,402.63 | 1,194.28 |

| – Provisions | 130.32 | 127.78 | 121.67 | 233.02 |

| – Deferred tax liabilities (net) | 202.37 | 202.11 | 207.80 | 207.16 |

| Total non-current liabilities | 1,375.60 | 1,604.54 | 1,732.10 | 1,634.46 |

| Current liabilities | ||||

| – Financial liabilities: – Borrowings | 7,171.13 | 7,075.09 | 6,518.94 | 6,056.89 |

| – Trade payables – Micro & Small enterprises | 21.46 | 17.90 | 7.28 | 12.13 |

| – Trade payables – Other than Micro & Small enterprises | 3,570.42 | 4,112.01 | 2,946.33 | 3,107.08 |

| – Other financial liabilities | 480.33 | 397.58 | 308.80 | 629.01 |

| – Other current liabilities | 1,695.70 | 978.32 | 857.35 | 1,299.68 |

| – Provisions | 17.83 | 17.40 | 18.14 | 16.81 |

| – Current Tax Liabilities | 199.45 | 130.34 | 61.87 | – |

| Total current liabilities | 13,156.32 | 12,728.64 | 10,718.71 | 11,121.60 |

| TOTAL EQUITY AND LIABILITIES | 17,060.65 | 15,153.81 | 12,862.35 | 13,881.92 |

Jyoti CNC Automation Restated Consolidated Statement of Profit and Loss (in ₹ million)

| Particulars | 6-Month Period Ended Sep 30, 2023 | 12-Month Period Ended Mar 31, 2023 | 12-Month Period Ended Mar 31, 2022 | 12-Month Period Ended Mar 31, 2021 |

|---|---|---|---|---|

| Revenue | ||||

| – Revenue from operations | 5,098.22 | 9,292.59 | 7,464.87 | 5,800.59 |

| – Other Income | 7.07 | 233.41 | 35.74 | 100.33 |

| TOTAL INCOME | 5,105.29 | 9,526.00 | 7,500.61 | 5,900.92 |

| Expenses | ||||

| – Cost of materials consumed | 952.87 | 6,795.30 | 4,187.80 | 4,638.57 |

| – Changes in inventories of finished goods and work-in-progress | 1,756.97 | (1,469.17) | 9.05 | (1,449.02) |

| – Employee benefits expense | 903.26 | 1,662.40 | 1,418.36 | 1,313.86 |

| – Finance costs | 491.85 | 897.02 | 821.99 | 755.12 |

| – Depreciation and amortization expense | 156.01 | 336.18 | 357.86 | 377.84 |

| – Other expenses | 741.11 | 1,330.28 | 1,123.04 | 980.28 |

| TOTAL EXPENSES | 5,002.07 | 9,552.01 | 7,918.11 | 6,616.65 |

| Profit before tax and exceptional items | 103.22 | 278.50 | (417.50) | (715.73) |

| Exceptional Items | ||||

| – Profit on Waiver of Loan | – | 304.50 | – | – |

| PROFIT BEFORE TAX | 103.22 | 278.50 | (417.50) | (715.73) |

| Current tax | 70.00 | 135.80 | 65.00 | – |

| Prior Period/Year Tax | – | 0.50 | – | – |

| Deferred tax | (0.30) | (8.40) | 0.50 | (15.44) |

| PROFIT FOR THE PERIOD / YEAR | 33.52 | 150.60 | (483.00) | (700.29) |

| Other Comprehensive Income | ||||

| – Foreign Currency Translation Reserve | – | -78.10 | -45.39 | |

| – Remeasurement gains/(losses) on post-employment defined benefit plans | 2.23 | 10.90 | (0.49) | (3.01) |

| – Income tax relating to items that will not be reclassified to profit or loss | (0.56) | (2.70) | 0.09 | 0.76 |

| Total Other Comprehensive Income/(loss) | 1.67 | 8.20 | (78.50) | (47.64) |

| Total Comprehensive Income for the Period / Year | 35.19 | 158.80 | (561.50) | (747.93) |

| Earnings per share (of ₹ 2) | ||||

| – Basic | 0.19** | 1.02 | (3.28) | (4.75) |

| – Diluted | 0.19** | 1.02 | (3.28) | (4.75) |

FAQs

When does the Jyoti CNC Automation IPO open and close?

the Jyoti CNC Automation IPO is open from 9th JAnuary to 11th January 2024.

What is the allotment date for the Jyoti CNC Automation IPO?

The allotment date for Jyoti CNC Automation IPO is 12th January 2024..

What is the listing date for the Jyoti CNC Automation IPO?

The Jyoti CNC Automation IPO will be listed on the 16th January 2024..

What is the price band for Jyoti CNC Automation IPO?

the price band for Jyoti CNC Automation IPO is Rs. 315-331.

Disclaimer: No financial information published anywhere on this site should be interpreted as a recommendation to buy or sell securities or as any other kind of offer to do so. Every piece of material published on this site is just for educational and informational reasons and under no circumstances should be used to make financial decisions. Before actually making any investment decisions based on the information provided here, readers must seek the advice of a licensed financial professional. Any actions made by readers based on the material presented here are done so entirely at their own risk. Investors should be aware that any stock market investment is exposed to unpredictably high market risks. The author has no intention of investing in this IPO.