Investing in mutual funds can be a great way to grow your money over time. When you visit any mutual fund AMC website you will come across various terms that might be difficult to understand but it’s important to understand the various terms and concepts associated with these types of investments. So let’s take a look at some of the most important terms you should know when it comes to mutual funds, such as AMC, NAV, SIP, STP, SWP, AUM, Exit Load, Expense Ratio, CAGR, XIRR, and Lock-in-period.

AMC (Asset Management Company)

First, let’s start with AMC, which stands for Asset Management Company. This is the company that manages the mutual fund, making decisions about which investments to buy and sell in order to achieve the fund’s stated investment objective. For example, HDFC mutual fund, and SBI mutual fund are among the largest AMC in India, managing multiple mutual funds.

NAV(Net Asset Value)

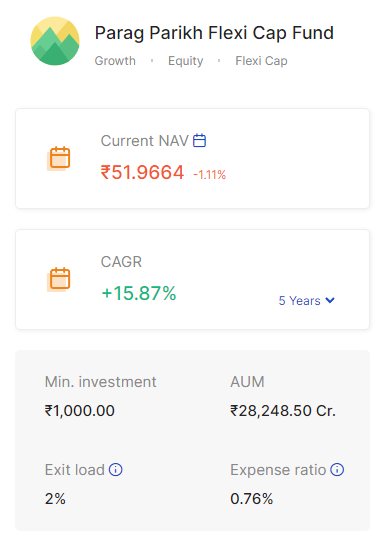

Next, we have NAV, which stands for Net Asset Value. This is the value of a mutual fund’s assets minus its liabilities, divided by the number of shares outstanding. NAV is used to determine the per-share value of a mutual fund. For example, a mutual fund with a NAV of $100 and 1,000 shares outstanding would have a per-share value of $100/1,000 = $1. Since the market value of securities changes every day, NAV of a scheme also varies on day to day basis. The NAVs of all Mutual Fund schemes ****are declared at the end of the trading day after markets are closed.

AUM (Assets Under Management)

AUM, or Assets Under Management, refers to the total value of assets that a mutual fund or asset management company manages. This can give you an idea of the size and scale of a mutual fund or AMC. For example, as of 2021, HDFC AMC has an AUM of $47.5 billion.

SIP (Systematic Investment Plan)

SIP, or Systematic Investment Plan, is a type of mutual fund investment where investors make regular, small contributions to the fund instead of a lump sum investment. This can make it easier for investors to invest regularly and dollar-cost average their investments. For example, an investor can set up a SIP of $100 per month to invest in a mutual fund.

STP (Systematic Transfer Plan)

STP, or Systematic Transfer Plan, is similar to SIP, but instead of investing money, STP allows you to transfer money from one mutual fund to another on a regular basis. This can be a great way to reallocate your investments over time. For example, an investor can set up an STP of $1000 per month to transfer from a debt fund to an equity fund.

SWP (Systematic Withdrawal Plan)

SWP, or Systematic Withdrawal Plan, is a feature some mutual funds offer that allows investors to make regular withdrawals from the fund. This can be a great way to create a steady stream of income from your mutual fund investments. For example, an investor can set up an SWP of $500 per month to withdraw from a balanced fund.

Exit Load

Exit load is a fee charged by some mutual funds when an investor sells their shares before a certain period of time, typically called the lock-in period. This fee is meant to discourage short-term trading and encourage long-term investing. For example, a mutual fund with an exit load of 1% if redeemed within 3 months of investment.

Expense Ratio

The expense Ratio is the annual fee that a mutual fund charges to cover its operating expenses. This fee is expressed as a percentage of the fund’s total assets, and it can have a significant impact on the fund’s returns over time. For example, a mutual fund with an expense ratio of 1.5% would have an annual fee of $1,500 for every $100,000 invested.

CAGR

CAGR, or Compound Annual Growth Rate, is a measure of the average annual return on an investment over a period of time. It takes into account the effect of compounding, making it a valuable tool for measuring the long-term growth of an investment. For example, if a mutual fund had a CAGR of 10% over a five-year period, it would have grown by an average of 10% per year over that time.

XIRR

XIRR, or Extended Internal Rate of Return, is a measure of the rate of return on an investment that considers the timing of cash flows. This can be a useful tool for evaluating the performance of a mutual fund or other investment over time. For example, if an investor invested $10,000 in a mutual fund and received $12,000 after 2 years, the XIRR would be the rate at which the $10,000 investment would grow to $12,000 over 2 years.

Lock in period

Finally, the lock-in period is a time period, usually 1-3 years, during which an investor cannot redeem their units, it’s a lock-in of investment and is meant to discourage short-term trading and encourage long-term investing. For example, if a mutual fund has a lock-in period of 3 years, an investor would not be able to sell their units for at least 3 years after investing.

Wow, wonderful blog format! How long have you been running

a blog for? you make running a blog glance easy. The entire look

of your web site is magnificent, let alone the content! You

can see similar here sklep online