What is a Mutual Fund?

A mutual fund is an investment vehicle that pools money from investors to buy stocks, bonds, and other securities. The fund is managed by professional money managers who decide which securities to buy and when to sell them. Mutual funds provide investors with diversification, which means they can spread their risk across different types of assets, such as stocks and bonds. Mutual funds also have the benefit of economies of scale, as the fund manager can purchase larger amounts of securities with the pooled money from investors.

Mutual funds are typically categorized by their investment objectives, such as growth, income, or a combination of both. These funds also have different levels of risk associated with them. For example, growth funds are typically more aggressive and have higher risks compared to income funds.

Understanding Mutual Fund Portfolio Overlap

When investing in mutual funds, it is important to understand the concept of mutual fund portfolio overlap. Portfolio overlap occurs when two funds have a high percentage of the same securities in their portfolios. This means that when one fund’s performance increases, the other fund’s performance also increases, and vice versa.

The overlap between the two funds can be determined by looking at the funds’ holdings. For example, if two funds have the same top 10 holdings, then the portfolio overlap is likely to be high.

Portfolio overlap is important to understand because it can have a significant impact on the performance of your portfolio. For example, if two funds have a high portfolio overlap, then when one fund’s performance increases, the other fund’s performance will also increase, resulting in increased risk and potential losses.

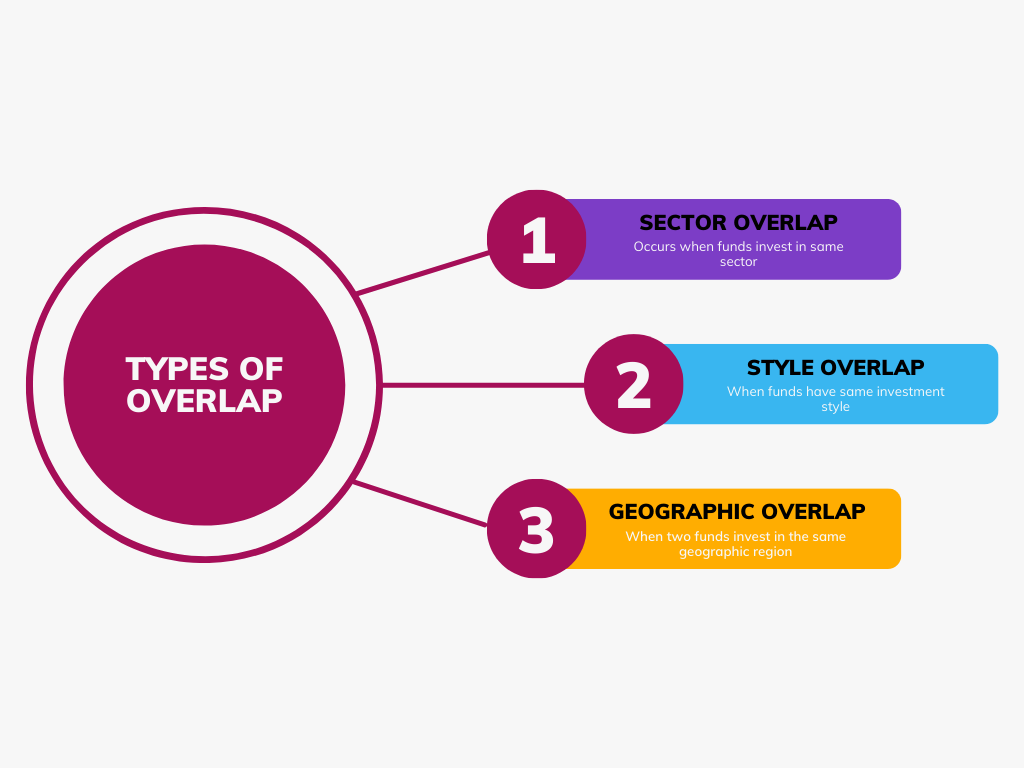

The Different Types of Mutual Fund Portfolio Overlap

There are several types of portfolio overlap that can occur between two mutual funds. The most common type is sector overlap, which occurs when two funds invest in the same sector. For example, two funds that invest in the banking sector are likely to have a high degree of portfolio overlap.

Another type of portfolio overlap is style overlap, which occurs when two funds invest in the same style of investing. For example, if two funds are both growth funds, then they are likely to have a high degree of portfolio overlap.

Finally, there is geographic overlap, which occurs when two funds invest in the same geographic region. For example, if two funds invest in the U.S. stock market, then they are likely to have a high degree of portfolio overlap.

Factors Affecting Portfolio Overlap

There are several factors that can affect the degree of portfolio overlap between two mutual funds. The most important factor is the fund manager’s investment strategy. If two funds are managed by the same manager, then they are likely to have a high degree of portfolio overlap.

Another factor is the size of the fund. Large mutual funds tend to have more diversified portfolios and therefore less portfolio overlap. On the other hand, smaller funds tend to have more concentrated portfolios and therefore more portfolio overlap.

Finally, the type of securities that the funds invest in can also affect portfolio overlap. Funds that invest in different asset classes, such as stocks and bonds, are likely to have less portfolio overlap than funds that invest in the same asset class.

How to check for Mutual Fund Portfolio Overlap

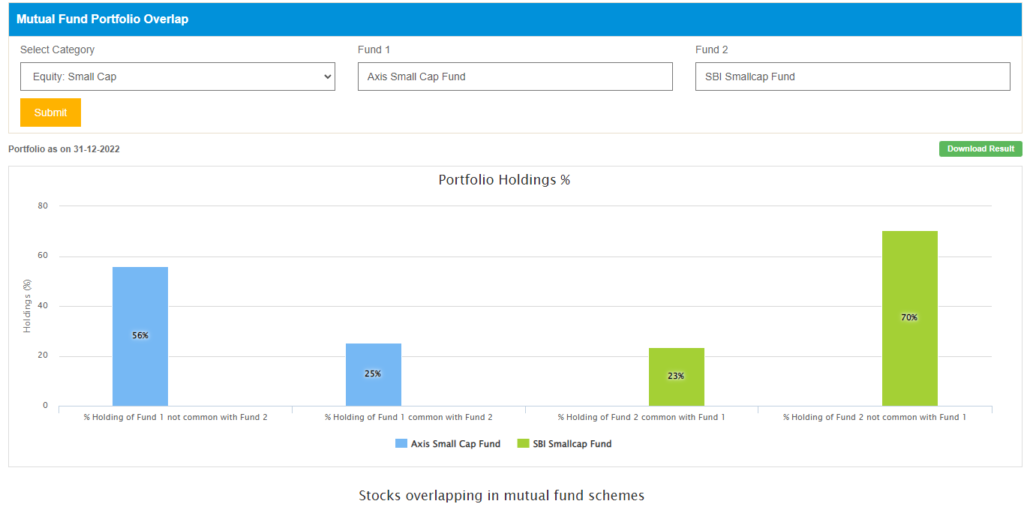

Many mutual fund research platforms also offer mutual fund overlap analysis tools that help investors compare the portfolios of different funds and identify any overlap.

Here we will use Advisorkhoj, you can use any of the available tools as results are not going to vary. Here you have to select the category of mutual funds and enter the names of the funds and you can see overlap results immediately.

if portfolio overlap comes out to be more than 30%, then we should consider trimming down the number of mutual funds.

Strategies to Minimize Mutual Fund Portfolio Overlap

There are several strategies that investors can use to minimize portfolio overlap between two mutual funds. The first strategy is to invest in funds with different investment objectives. For example, if you are investing in a growth fund, you should also invest in an income fund to diversify your portfolio and reduce portfolio overlap.

The second strategy is to invest in funds with different fund managers. This will help ensure that the funds have different investment strategies and portfolios.

The third strategy is to invest in funds with a different geographic focus. By investing in funds that focus on different regions or countries, you can reduce portfolio overlap and diversify your portfolio.

Finally, the fourth strategy is to invest in funds with different types of securities. By investing in both stocks and bonds, you can reduce portfolio overlap and diversify your portfolio.

Conclusion

Understanding mutual fund portfolio overlap and strategies to minimize it is an important part of investing in mutual funds. By understanding the different types of portfolio overlap, factors affecting portfolio overlap, and strategies to minimize it, you can ensure that your portfolio is diversified and that you are not exposed to unnecessary risk.

Additionally, it is important to evaluate the performance of the fund and its holdings to ensure that you are making the right investment decisions. Mutual funds can offer many advantages, such as diversification, cost savings, and professional money management, but they also come with some disadvantages, such as a lack of control and high fees. By understanding these concepts, you can make informed decisions when investing in mutual funds.

Thank you for taking the time to read this blog post. I hope you found it informative and enjoyable. I would love to hear your thoughts on the topic and any suggestions you may have for future posts. Please feel free to leave a comment below.

If you found this article helpful, please share it with your friends and colleagues. Your support means a lot to me and helps me to create more valuable content in the future.

Thank you again for your time and support!

What is mutual fund overlap?

Mutual fund overlap occurs when two or more schemes in a portfolio have the same stocks as their holding.

What is the recommended overlap?

If the overlap is more than 30% between two mutual funds then you should consider keeping only one of them in your portfolio.

How do you check multiple mutual funds overlap?

The easiest way to identify mutual fund portfolio overlap is to compare the portfolio holdings of two or more mutual funds.

3 thoughts on “Understanding Mutual Fund Portfolio Overlap and Strategies to Minimize It”