Sometimes investors like to transfer shares from one demat account to another. These two demat accounts (sender and receiver) can be with the same broker or with different brokers. For this purpose, we will have to use a facility provided by CDSl which is called EASIEST.

To know about this facility in detail and to know the complete procedure read this article till the end.

What is CDSL EASIEST?

CDSL EASIEST (Electronic Access to Securities Information and Execution of Secured Transactions ) is a simple service being offered by CDSL that allows stock unit holders to send instructions to buy, sell or transfer stocks.

With CDSL Easiest, you can transfer stocks from one account to another using the internet. It’s super easy and convenient.

How to register for EASIEST facility?

To register for CDSL Easiest, follow these steps:

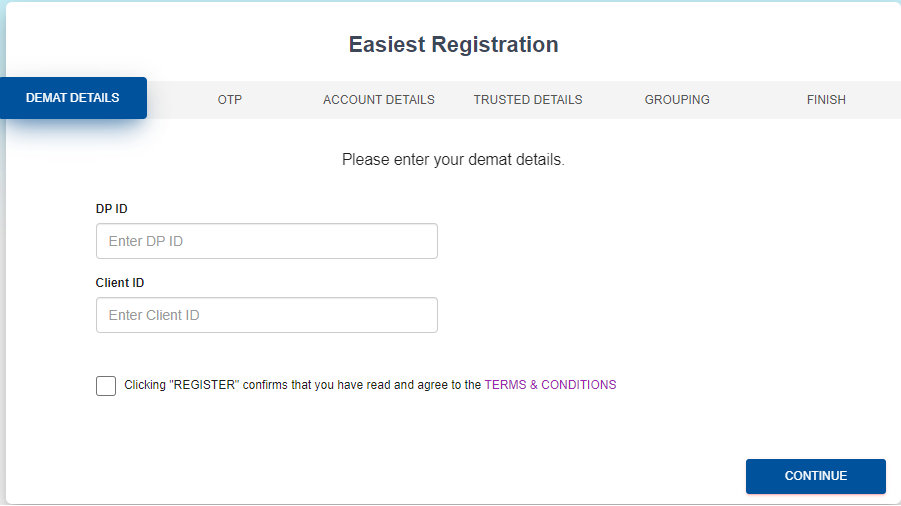

- Visit https://web.cdslindia.com/myeasitoken/Registration/EasiestRegistration

- Enter the 8-digit DP ID followed by the 8-digit demat client ID or BO ID and click on Continue. You can find Zerodha DP id and BO id at https://console.zerodha.com/account/demat

- Enter OTP received on the registered mobile number and click on Continue.

- In the next step select the username of your choice. Select a security question and type in your answer. Below this you will find two options under account type:

- Account of choice: The Account of Choice Transfer allows you to move securities from one account holder (BO) account to another demat account. To ensure the security of transactions, authentication is performed using a Digital Signature Certificate (DSC) or e-token. This certificate needs to be obtained from any of the Registered Authorities (RA). To initiate the transfer, the BO is required to submit a simple registration form, signed by all account holders (except sole holders), along with the Registering Authority (RA) form for linking the digital signature (e-token) to the DP for authentication. Transfers can be made between depositories, such as CDSL to CDSL and CDSL to NSDL.

- Trusted account: Trusted accounts refer to demat accounts that clients choose to transfer their securities through the easiest method. With trusted account transfers, clients (Beneficiary Owners) can move their securities to up to four CDSL demat accounts of their preference, which they have designated as trusted accounts. Transactions conducted using the trusted account option require an additional PIN for approval, which is sent to the BO via email separately. Opting for the trusted account option entitles the BO to receive two separate emails containing two distinct passwords: one for logging into the easiest platform and the other for authorizing their transactions through the PIN. For detailed instructions on adding a trusted account on CDSL Easiest, please refer to the guide. Transfers can only be made within the depository, specifically from CDSL to CDSL.

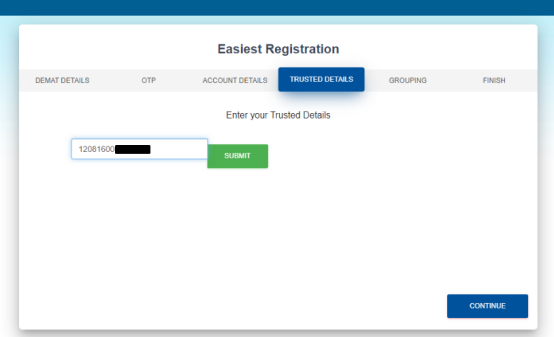

- Enter the trusted account details, i.e., a 16-digit demat ID of the CDSL account where stocks need to be transferred and click on Continue.

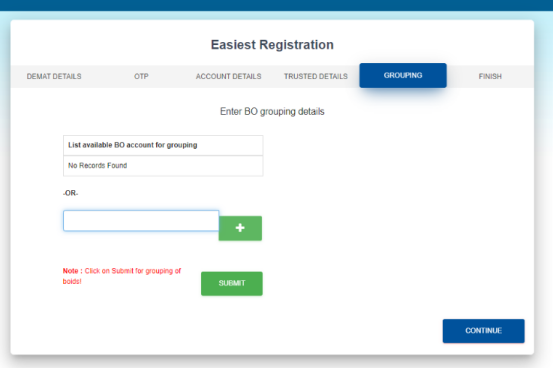

- Grouping: This step is optional but useful. If you have existing CDSL demat accounts with other brokers, you can consolidate them using this option. By grouping these accounts, the BO IDs associated with them will already be pre-approved. To add an existing CDSL demat account as a trusted account, simply select the corresponding BO ID and click on “Continue.” Alternatively, if you prefer to skip this step, you can proceed by clicking on “Continue” without selecting any BO ID.

- The registration is now complete, and after your broker authenticates it, CDSL easiest will be activated for the BO ID. The activation takes up to 48 working hours.

Before starting the transfer of shares from one demat account to another demat account you must register for CDSL EASIEST facility as explained above and add the trusted account.

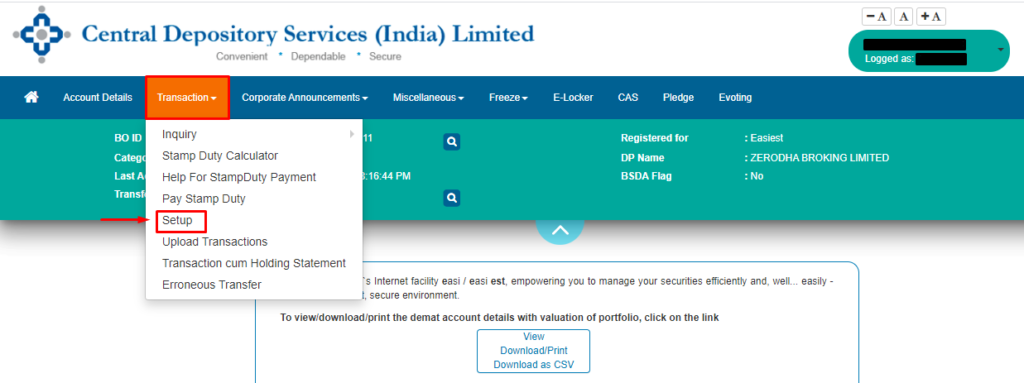

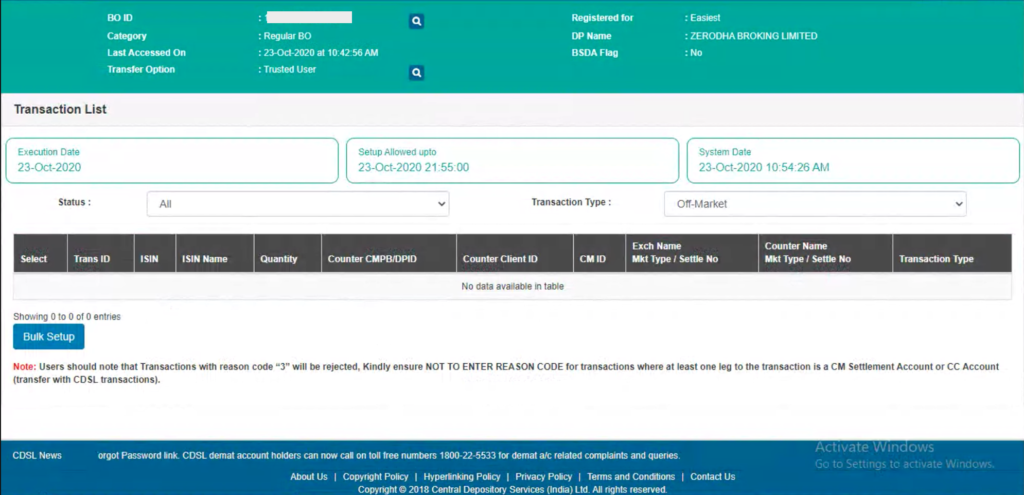

- Once the trusted account is set up, go to ‘Setup’ in the transaction section.

- Select Bulk Setup.

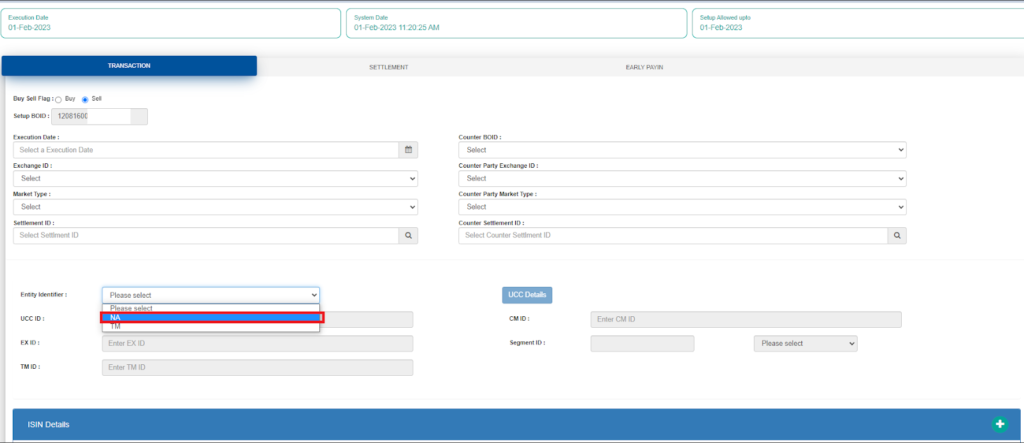

- Click on the Transaction tab.

- Enter the below details and Submit

- Execution date.

- Recipient BO ID.

- ISIN

- Quantity

- Reason for transfer

- Click on Account ISINs and select the ISINs in the holdings from the list. Enter the quantity and select the reason for the trade. If the off-market transfer is not a gift or self-transfer and involves a consideration, stamp duty (PDF) must be paid to CDSL online (PDF) before making the transfer.

- Click on submit then Commit.

- Enter your CDSL Easiest PIN and click on OK. (8- digit pin received at the time of CDSL Easiest registration)

Once the DP confirms the request, the shares get transferred.

FAQs

What is the difference between easi and easiest?

Easiest is the upgraded version of easi which provides you the extra options which are not available in the easi.

The charges to transfer shares in an off-market transaction are 0.03% of the transfer value or ₹25 per ISIN, whichever is higher, + 18% GST. Clients must maintain the required balance for the charges to be debited.

Thank you for taking the time to read this blog post. I hope you found it informative and enjoyable. I would love to hear your thoughts on the topic and any suggestions you may have for future posts. Please feel free to leave a comment below.

If you found this article helpful, please share it with your friends and colleagues. Your support means a lot to me and helps me to create more valuable content in the future.

Thank you again for your time and support!