HDFC Regalia gold credit card is one the most lucrative credit cards being offered by HDFC bank. With this card, you get some luxurious rewards as welcome benefits such as Club Vistara Silver membership and MMT Black membership. Apart from accelerated reward points you also get access to domestic and international airport lounges.

To know about the features, benefits and charges of the HDFC regalia gold credit card, Read till the end!

Overview

| Type | Rewards Credit Card |

| Card network | VISA |

| Annual Fee | 2500 + GST |

| Welcome benefit | Rs 2500 gift voucher on joining |

| Best use | Shopping and Travel |

| Best Feature | 5,000 worth flight vouchers on annual spends of Rs. 5 lakh and an additional voucher of Rs. 5000 on spends of Rs. 7.5 lakhs |

| Helpline number | 1860 425 1188 |

HDFC Bank Regalia Gold Credit Card – Features & Benefits

Welcome benefits

After joining successfully you will get a welcome voucher of Rs. 2500. You will also get MMT Black Elite and Club Vistara Silver Tier membership on spending over 1 lakh in the first 90 days.

About MMT Black

MMT BLACK is an invite-only spend-linked rewards program in which you earn My Cash on crossing various spend levels on bookings, starting at ₹20,000. You can earn up to ₹25,000 My Cash which can be used 100% (with no restrictions) to make bookings or to claim exciting vouchers. To Know more about MMT Black Read this.

About Club Vistara Silver Tier

Club Vistara (CV) is Vistara’s loyalty program where you can earn and redeem points on Vistara, Singapore Airlines and Silk Air flights and also on hotel bookings and cab rentals. In CV Silver you earn 9 CV points per Rs. 100 spent. Benefits of CV Silver include priority waitlist clearance, check-in at the Premium Economy counter, extra baggage allowance of 5kg or 1 piece if you book with Economy lite fare, one lounge access voucher, and one upgrade voucher. To read more click here.

Spends based benefits

- If you spend Rs. 1.5 lakh in a calendar quarter, you will get an E-voucher of Rs. 1,500. You can redeem these vouchers on M&S, Myntra, Marriott, and Reliance Digital but you can redeem only one voucher per merchant per quarter.

- You can get a free flight ticket worth Rs. 5000 if you spend Rs. 7.5 lakhs on your credit card in a card anniversary year. You will be able to generate a voucher code for the flight ticket once you reach the annual spending milestone.

- Your card’s anniversary year is a 365-day period that starts on the date you set up or last upgraded/downgraded your card. For example, if you set up or upgraded/downgraded your card on January 1, 2022, your anniversary year would be from January 1, 2022, to December 31, 2022. This pattern continues for each subsequent anniversary year.

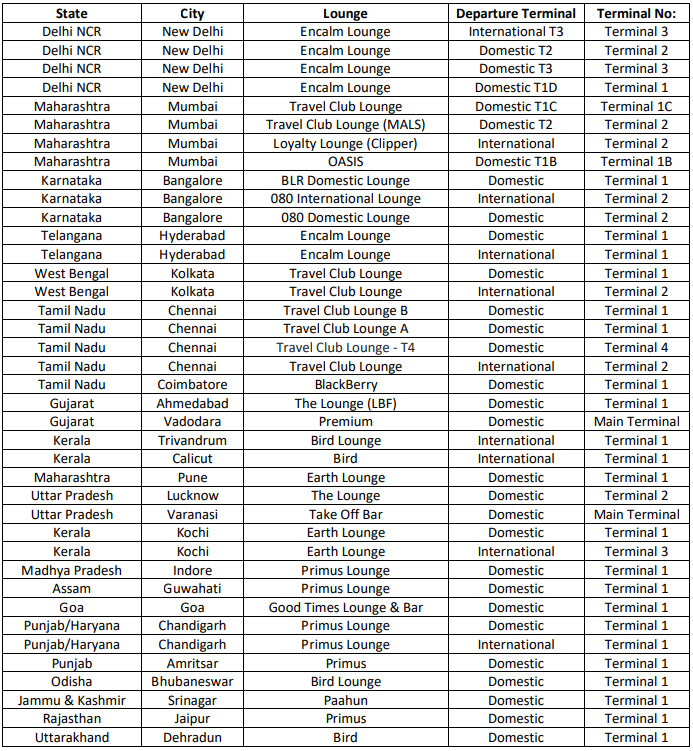

Domestic lounge access list for Regalia Gold Credit Card

You will get 12 complimentary airport lounge visits annually in India (domestic and international) with the HDFC Bank Regalia Gold Credit Card. Click here to see the list of participating lounges.

International lounge access

You and your add-on cardholder will get 6 complimentary international lounge access with the HDFC Bank Regalia Gold Credit Card. But to use this facility you will have to apply for the priority pass first. You can apply for the Priority Pass for yourself and add-on members after completing at least 4 retail transactions with your HDFC Bank Regalia Gold Credit Card. Click here to apply for the priority pass.

Airport pick-up and drop

Book your flight tickets through the HDFC Bank Regalia Gold Unified Smartbuy portal to get complimentary airport pick-up and drop-off services. Generate your voucher code and use it in the Ola app.

Reward points

- 4 Reward points on every Rs. 150 spent on Insurance, Utilities and Education

- 20 Reward Points on every Rs.150 spent at Marks & Spencer, Myntra, Reliance Digital, Nykaa. The limit for these RP is 2000 per month.

- Reward points will be valid for 2 years from the date of generation.

Reward points redemption value

- Exclusive Gold Catalogue on select Premium brands via Smartbuy at a value of 1 RP = Rs 0.65

- Flights and hotel bookings via Smartbuy at a value of 1 RP = Rs 0.5

- Airmiles conversion through Netbanking or SmartBuy at a value of 1RP = upto 0.5 airmiles

- Products and Vouchers via Netbanking or SmartBuy at a value of 1 RP = upto Rs 0.35

- The redemption against the statement balance will be at the rate of 1 RP = Rs 0.20

Zero lost card liability

Report a lost HDFC Bank Regalia Gold credit card immediately to avoid liability for fraudulent transactions. Call the bank’s 24/7 customer support at 1800-258-6000.

Insurance

- Air accident – Cover of INR 10 Lakh to primary cardholder

- Overseas hospitalisation – Cover of INR 15 Lakh on international travel. For emergency medical expenses call Toll Free: +800 08250825

- Card liability cover – up to 9 Lakh

Also Read: Scapia Federal Bank Credit Card: A 2023 Guide

Fee and charges

| Fee Type | Fee Amount (INR) |

| Joining Fee | Rs. 2500 + GST |

| Renewal Fee | Rs. 2500 + GST (Waived if spent 4 lakh in a year) |

| Add-on Card Fee | Life time free |

| Cash Withdrawal Fee | 2.5% or ₹500, whichever is higher |

| Interest on Cash Advance | 3.49 % per month |

| Card Replacement Fee | Nil |

| Reward Point Redemption Fee | Rs. 99 |

| Renewal Benefit | Nil |

Late payment fee

Cardholders should try to pay the complete due amount before the bill date. If you can’t pay the complete amount by the due date, interest charges as well as a late payment fee will be applied by the bank. Moreover, GST will also be added upon interest charges and late payment fees. These late payment charges shall be as follows:

| Balance amount | Late Payment Charge (Rs.) |

| Less than Rs. 500 | 0 |

| Rs. 500– Rs. 5000 | 500 |

| Rs. 5,001 – Rs. 10,000 | 750 |

| greater than Rs.10,000 | 1200 |

Eligibility HDFC Regalia Gold Credit Card

HDFC Bank Regalia Gold Credit Card is a premium credit card that offers a wide range of benefits and rewards. To be eligible for this card, you must be an Indian national between the ages of 21 and 65 years. If you are a salaried individual, your net monthly income must be at least Rs. 1,00,000. If you are self-employed, your ITR must be greater than Rs. 12 lakhs per annum.

Also Read: IndusInd pinnacle credit card review

Documents required for HDFC Regalia Gold Credit Card

The following documents are required for the application of Neo credit card:

- PAN card photocopy or Form 60

- Colour photograph

- Latest payslip/Form 16/IT return copy as proof of income

- Residence proof (any one of the following):

- Passport

- Ration Card

- Electricity bill

- Landline telephone bill

- Identity proof (any one of the following):

- Passport

- Driving license

- PAN card

- Aadhaar card

Additional resources to read

Conclusion

The HDFC Regalia Gold Credit Card is a premium credit card that offers a wide range of benefits and rewards, including welcome benefits, spend-based benefits, domestic and international lounge access, airport pick-up and drop, reward points, zero lost card liability, and insurance. The card is especially well-suited for frequent travellers and shoppers, as it offers accelerated reward points on select merchants and flight vouchers on reaching spending milestones.

Despite the high annual fee, the HDFC Regalia Gold Credit Card is a good option for responsible credit card users who value the benefits and rewards that it offers.

Please share your opinion on the HDFC Regalia Gold Credit Card in the comments section below.

FAQs

What is the joining and annual fee for HDFC Regalia Gold Credit Card?

The joining and renewal fee for this credit card is Rs. 2500.

Is lounge access available for HDFC Regalia Gold Credit Card?

12 domestic and 6 international airport lounge access is available for this credit card.

What is the eligibility criteria for the HDFC Regalia Gold Credit Card?

HDFC Bank HDFC Bank Regalia Gold Credit Card Eligibility:

For Salaried Indian national

-Age: Min 21 years & Max 60 Years,

-Net Monthly Income> Rs 1,00,000

For Self Employed Indian national

-Age: Min 21 years & Max 65 Years

-Income: ITR > Rs 12 Lakhs per annum

What is the maximum limit for HDFC Regalia Gold Credit Card?

There is no fixed upper limit for this credit card, however, the actual credit limit offered to you will be at the discretion of the bank and will depend on several factors, including your credit history, credit score, and income.